Editor’s Note: The article below is a reprint of a recent issue brief supported by the State Health and Value Strategies (SHVS) program, a grantee of the Robert Wood Johnson Foundation. The views expressed here do not necessarily reflect the views of the foundation.

Background

To date, the Centers for Medicare & Medicaid Services (CMS) has approved nearly 400 section 1902(e)(14) waivers that 52 states (including Washington D.C.) and territories are employing to support the return to regular eligibility and enrollment operations following the expiration of the Medicaid continuous coverage requirement. These waivers, authorized under section 1902(e)(14)(A) of the Social Security Act, are intended to help states increase ex parte renewal rates,1 support enrollees with updating their contact information and completing the renewal form, and facilitate the reinstatement of eligible individuals who were disenrolled for procedural reasons.

While CMS has encouraged state take-up of unwinding-related section 1902(e)(14) waivers since March 2023, recent data concerning Medicaid and Children’s Health Insurance Program (CHIP) disenrollment and procedural disenrollment among children has reignited CMS’ focus. With CMS’ December release of Medicaid unwinding-related guidance and the United States Department of Health and Human Services’ targeted letters to states, federal partners are urging states to take advantage of the flexibilities at their disposal to prevent eligible individuals, particularly children, from losing coverage. As part of this push, CMS announced an extension of all unwinding-related section 1902(e)(14) waivers through December 31, 2024 (or a later date approved by CMS)2 and offered new operational considerations and illustrative scenarios to assist states in implementing the waivers.

This issue brief is intended to help states evaluate whether to take up additional section 1902(e)(14) waiver flexibilities and determine which to explore further based on emerging evidence of their effectiveness.

Promising Linkages Between Section 1902(e)(14) Waivers and Renewal Outcomes

States differ substantially in the number and type of section 1902(e)(14) waivers they are adopting, ranging from zero to 15 (with a national average of seven). Varying state uptake can be attributed to a number of unique state factors, such as ability to nimbly update eligibility and enrollment systems, competing policy and operational priorities, and a need to come into compliance with federal renewal requirements.

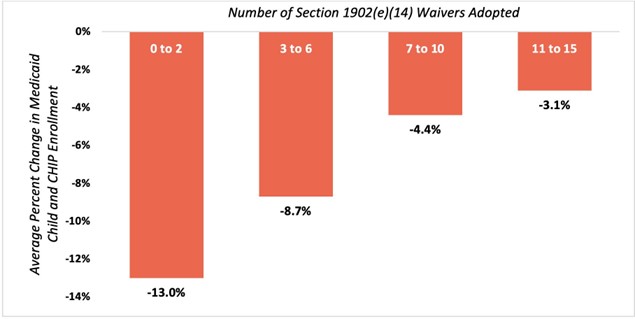

Emerging evidence indicates a positive linkage between state take-up of these waivers and renewal outcomes during the unwinding period. Recent findings from CMS demonstrate that higher state uptake of unwinding-related section 1902(e)(14) flexibilities is associated with a smaller percent change in Medicaid and CHIP child enrollment (see Figure 1 below). States that availed themselves to 11 or more section 1902(e)(14) flexibilities experienced only a 3% average change in Medicaid/CHIP child enrollment, as compared to states that adopted up to two flexibilities, which translated to a 13% average change in Medicaid/CHIP child enrollment during the same time period. This data suggests that state uptake of section 1902(e)(14) waivers impacts continuity of Medicaid and CHIP coverage among children.

Figure 1: Average Percent Change of Medicaid Child and CHIP Enrollment by the Number of Section 1902(e)(14) Waivers Adopted Between March and September 2023

Source: CMS Medicaid and CHIP Enrollment: Child and Youth Data Snapshot, December 18, 2023. See slide 14.

Insights Into High-Value Section 1902(e)(14) Flexibilities

Section 1902(e)(14) waivers mitigate coverage loss by increasing rates of ex parte renewals and assisting individuals in updating contact information and completing renewal forms. For example, higher rates of ex parte renewals are significantly correlated with lower rates of Medicaid and CHIP disenrollment among children.3 Through a recent qualitative assessment, State Health and Value Strategies and Manatt Health analyzed anonymous insights from states and identified strategies that states consider to be most impactful. Notably, states expressed substantial interest in making permanent flexibilities that increase ex parte rates and provided anecdotal insights establishing the effectiveness of such flexibilities. States also indicated that they would like to permanently maintain certain flexibilities to support enrollees with the renewal process. Table 1, below, compiles high-value section 1902(e)(14) strategies that states may want to implement to promote continuity of coverage and care.

Table 1. High-Value Section 1902(e)(14) Flexibilities for States to Prioritize

| 1902(e)(14) Flexibility |

Description |

Rationale for Considering High-Value4 |

|

Strategies to Increase Ex Parte Rates

|

|

Targeted Supplemental Nutrition Assistance Program (SNAP)/ Temporary Assistance for Needy Families (TANF) Strategy

|

Allows states to renew Medicaid eligibility based on financial findings that show SNAP or TANF gross income and/or assets (if applicable) are below Medicaid limits, despite the differences in household composition and income-counting rules. |

Enables states to renew on an ex parte basis a large proportion of Medicaid enrollees, since the majority of individuals who have already been determined eligible for SNAP are highly likely to be eligible for Medicaid. |

|

$0 Income Strategy

|

Allows states to renew Medicaid eligibility when no data is returned for an individual who had $0 income recorded in the eligibility system. |

Reduces administrative burden by enabling states to renew on an ex parte basis individuals with $0 income, since no data sources will return in support of an eligibility determination if the individual had

$0 income. Additionally, individuals are unable to document $0 income even when a state sends an

individual a renewal form. |

|

100% of the Federal Poverty Level (FPL) Income Strategy

|

Allows states to renew Medicaid eligibility for individuals with income at or below 100% of the FPL when no data is returned. |

Like the $0 Income Strategy, this strategy reduces administrative burden by enabling states to renew on an ex parte basis individuals with income at or below 100% of the FPL for whom no data sources return (e.g., for self-employed individuals).

|

|

Asset Verification System (AVS) Strategy

|

Allows states to renew Medicaid eligibility for individuals for whom information from the AVS is not returned at all or within a reasonable timeframe. |

Supports administrative efficiencies by allowing states to assume no change in resources verified through the AVS when no information is returned through the AVS or when the AVS call is not returned within a reasonable timeframe.

|

|

Strategies to Support Enrollees with Renewal Processes

|

|

National Change of Address (NCOA)/United States Postal Service (USPS) and Managed Care Plan Beneficiary Contact Updates

|

Allows states to rely on information provided by NCOA/ USPS and/or managed care plans to update contact information without taking an additional step to verify the new information. |

Helps to ensure that notices and renewal forms are mailed to the correct address.

|

|

Managed Care Plan Renewal Support Strategy

|

Permits managed care plans to assist members in completing and submitting the Medicaid/ CHIP renewal form. |

Alleviates states’ workforce challenges and leverages available application assistance to support enrollees.

|

Note: This is not an exhaustive list of high-value section 1902(e)(14) strategies that states may wish to consider taking up.

In addition to the strategies above, states may consider requesting authority to implement other section 1902(e)(14) strategies—such as the newer option to extend the renewal period for children for up to 12 months to give families additional time to renew their children’s coverage (as Kentucky and North Carolina have done), or bespoke waivers unique to a state’s circumstances. States interested in taking up additional flexibilities should contact their CMS state lead or State Health and Value Strategies, which can provide technical assistance prior to states reaching out to CMS. CMS has also offered to provide sample language that states may use to craft their letters requesting waiver authority.

Permanent Authorization of Section 1902(e)(14) Flexibilities

While it remains to be seen which, if any, unwinding-related section 1902(e)(14) waivers will be authorized on a permanent basis, CMS notes in its December Center for Medicaid and CHIP Services Informational Bulletin that “Additional guidance on the continued availability of these [section 1902(e)(14)] strategies is forthcoming.” CMS has also indicated that it will consider state-specific requests to continue use of select section 1902(e)(14) waivers as part of states’ plans to achieve full compliance with the federal renewal requirements. This suggests that CMS is likely to consider state-specific requests to extend section 1902(e)(14) flexibilities past December 31, 2024.

Further, if finalized as written, the “Streamlining the Medicaid, Children’s Health Insurance Program, and Basic Health Program Application, Eligibility Determination, Enrollment, and Renewal Processes” rule (i.e., “the E&E rule”) would impact certain state activities that currently require section 1902(e)(14) authority. For example, the E&E rule would:

- Eliminate the requirement that individuals apply for other public benefits, making moot the section 1902(e)(14) Applying for Other Benefits Strategy, which allows states to suspend the requirement that individuals apply for other public benefits under 42 C.F.R. § 435.608.

- Allow states to treat updated in-state mailing address information from USPS/NCOA and managed care plans as reliable and to update the enrollee case record with the new contact information (even if the enrollee does not respond), provided the state conducted the required outreach and gave the individual a reasonable period of time to verify the accuracy of the information. The rule would require the state to first send a notice to the address on file prior to updating the contact information.5 This change would negate the need for CMS to authorize permanently the NCOA/USPS and Managed Care Plan Beneficiary Contact Updates Strategy.

Conclusion

While the unwinding period is coming to an end in some states, others are negotiating extensions with CMS and are likely to push out their unwinding timelines past May 2024 and, in a few cases, well into 2025. Regardless of a state’s end date for unwinding, it is not too late to consider adopting section 1902(e)(14) flexibilities that may remain in place through December 31, 2024, at a minimum. In addition to supporting unwinding, these waivers may be essential as states work through workforce constraints, application backlogs, and systems changes necessary to achieve long-term compliance with the federal renewal requirements. In driving towards the shared goal of ensuring continuity of coverage and care for eligible people and in light of state interest in maintaining these flexibilities, CMS also has a key role—both in determining which strategies will be incorporated on a permanent basis into the Medicaid program and in offering administrative simplifications to facilitate permanent take-up.

1 “Exparte”refers to verifying eligibility based on a review of available data sources without needing to send a renewal form and request information/ documentation from the enrollee.

2 CMS will also allow states to request new waiver authorities through this same time period.

3 States with the lowest rates of ex parte renewals (between 0% and 15%) experienced a nearly 10% average decrease in Medicaid/CHIP child enrollment, as compared to states with the highest rates of ex parte renewals (between 41% and 91%), which experienced on average about a 2% average decrease over the same time period.

4 Also see CMS, Available State Strategies to Minimize Terminations for Procedural Reasons During the COVID-19 Unwinding Period: Operational Considerations for Implementation (December 2023).

5 Proposed 42 C.F.R. § 435.919(g).