On November 10, the Supreme Court is scheduled to hear oral arguments in California v. Texas—formerly referred to as Texas v. United States1—a case challenging the constitutionality of the Affordable Care Act (ACA).

The death of Justice Ruth Bader Ginsburg and the nomination of Seventh Circuit Court Judge Amy Coney Barrett to fill her seat have focused attention on the politically charged case. Last week, during the Senate Judiciary Committee nomination hearings, committee Democrats repeatedly asked Judge Barrett about how she would interpret the case. Consistent with the practice of other court nominees, Judge Barrett refused to speculate about how she might rule on the case. However, Judge Barrett stated that she was not “on a mission” to overturn the ACA. The Judiciary Committee is expected to vote on Judge Barrett’s nomination on October 22, setting up a timeline for a Senate floor vote the week of October 29.

If the ACA is ultimately overturned in its entirety, it would create massive upheaval across the nation’s healthcare system. (NOTE: Click here to view for free Manatt’s recent webinar on what the Supreme Court vacancy could mean for the ACA and to download a free copy of the presentation.)

Background and Potential Supreme Court Outcomes

The ACA imposed a mandate that individuals maintain health coverage or pay a tax penalty. In 2012, the Supreme Court upheld this individual mandate as a constitutional exercise of Congress’s power to impose taxes for the general welfare. In 2017, Congress set the tax penalty at $0, prompting a coalition of Republican-led states to sue, arguing that the mandate is no longer a tax and is therefore unconstitutional. Further, these states argued that the rest of the ACA is inseverable from the mandate and must be struck down with the unconstitutional mandate. The federal Department of Justice declined to defend the constitutionality of the mandate, and a coalition of Democrat-led states intervened to defend it.

In December 2018, a Texas federal district court held the mandate to be unconstitutional and ruled that the mandate cannot be severed from other provisions of the ACA, striking the entire law down. The decision was appealed to the U.S. Court of Appeals for the Fifth Circuit.

In late 2019, a Fifth Circuit panel held the individual mandate to be unconstitutional but remanded the case to the district court to conduct a more detailed analysis of whether the mandate was severable from other parts of the ACA. The Democrat-led states petitioned the Supreme Court to review the Fifth Circuit decision and the Supreme Court agreed to hear the case.

The earliest a decision is likely to be published is January 2021. But a decision could be published at any time until the term ends in early summer of 2021.

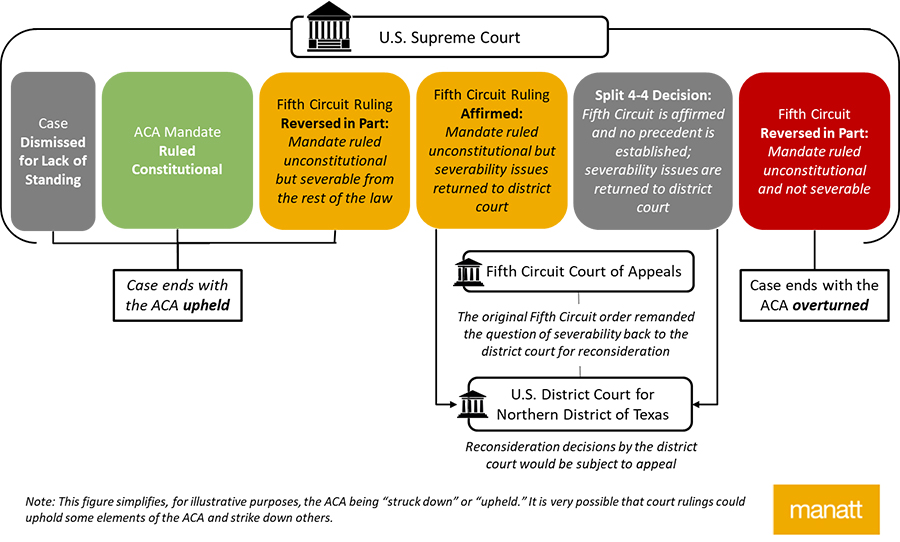

There are many possible outcomes in the case, but they fall into five major categories.

- The mandate remains constitutional, or the Court concludes there is some reason, such as a lack of standing, that it need not address the constitutionality of the mandate at all. The case ends, and the ACA is upheld.

- The Fifth Circuit decision is reversed in part: The Court agrees the mandate is unconstitutional but, unlike the Fifth Circuit, does not remand the decision on severability to the district court. Instead, the Court rules the mandate is severable from the remainder of the ACA, which is upheld.

- The Fifth Circuit decision is affirmed: The mandate is unconstitutional, but the Court does not decide the severability question, remanding the case to the district court to consider the issue further.

- If a new justice is not seated in time to hear the case, a split 4-4 decision would also affirm the Fifth Circuit decision and return the case to the district court, without a precedential Supreme Court decision.

- The Fifth Circuit decision is reversed in part: The Court agrees the mandate is unconstitutional, but the Court—overruling the Fifth Circuit and affirming the district court—concludes that the mandate is not severable from the rest of the ACA, striking the law down in its entirety.

Figure 1: Supreme Court California v. Texas Decision Scenarios

Under a narrow severability ruling, select provisions of the ACA could be struck down and others would be allowed to stand. Provisions that are the most likely to be overturned under a narrow severability ruling include community rating, guaranteed issue, prohibition of pre-existing condition exclusions and health status discrimination.

If the Supreme Court rules the ACA is entirely inseverable from the individual mandate, it would result in a massive disruption of healthcare coverage and markets—as well as unprecedented challenges for regulators charged with its unwinding. Some potential areas of impact include:

Federal premium tax credits could no longer be available to people who enrolled in insurance through state or federal Marketplaces; as of 2019, over 8.5 million Marketplace enrollees were receiving advance premium tax credits.2

- State Medicaid expansions may be rolled back, disrupting coverage for millions; as of 2019, over 14.8 million Americans are enrolled in the Medicaid expansion group.3

- Pre-existing condition protections could be reversed.

- The coverage gap or donut hole could return to the Medicare Part D prescription drug program

- The Center for Medicare & Medicaid Innovation and related offices would no longer have authority to run model tests, grant waivers or fund innovation projects, while the Accountable Care Organization program statute would lose legal force.

- Changes to the Medicaid Drug Rebate Program could be invalidated.

- Changes to Medicare reimbursement rates and benefits and quality bonus payments to Medicare Advantage plans might be unwound.

Potential Preventative Action by Congress and States

It is possible that Congress would pass legislation addressing the legal questions in the case before a decision is reached, making the case moot. These legislative options include:

- Change the individual mandate penalty from $0 to an amount that will generate revenue for the government.

- Repeal Section 5000A of the Internal Revenue Code (i.e., the individual mandate).

- Pass legislation declaring the individual mandate is severable from the rest of the ACA.

- Pass health reform legislation that replaces the ACA.

However, without bipartisan support, successfully passing a legislative intervention would require eliminating the legislative filibuster or passing legislation via budget reconciliation with a simple majority before the Supreme Court decision is released. Both of these options are significantly easier with single-party control of the legislative and executive branches to prevent a presidential veto.

Many of the ACA health insurance reforms could be enacted as state laws, such as a prohibition on pre-existing condition exclusions. Some states have already enacted these in state law, so little will change in those states regarding health insurance regulation. Other states may choose to do the same. On the other hand, some states have laws automatically repealing their laws if the ACA is struck down, and those states should consider the potential consequences of those laws. Nonetheless, in addition to establishing consumer protections for health insurance, the ACA created substantial federal subsidies for low- and moderate-income individuals, the Medicaid expansion, and premium tax credits. Without that funding, state laws will do little to replace the coverage available today. Further, states do not have the power to re-enact ACA provisions that affect Medicare or self-insured employment-based health plans.

1 When Texas and its allies initially filed their complaint in the district court, the United States was defending the ACA. Subsequently, the federal government decided not to defend the constitutionality of the mandate, but California and other states intervened to defend the statute. California (and its allies) petitioned the Supreme Court to hear the case, and Texas (and its allies) responded to the petition, hence the current case name.

2 Kaiser Family Foundation, Estimated Total Premium Tax Credits Received by Marketplace Enrollees, July 2020.

3 Congressional Budget Office, Federal Subsidies for Health Insurance Coverage for People Under Age 65: 2018 to 2028.