Maine Releases Draft Waiver Request Proposing New Eligibility Requirements

By Patricia Boozang, Senior Managing Director | Deborah Bachrach, Partner | Mindy Lipson, Senior Manager | Nina Punukollu, Consultant

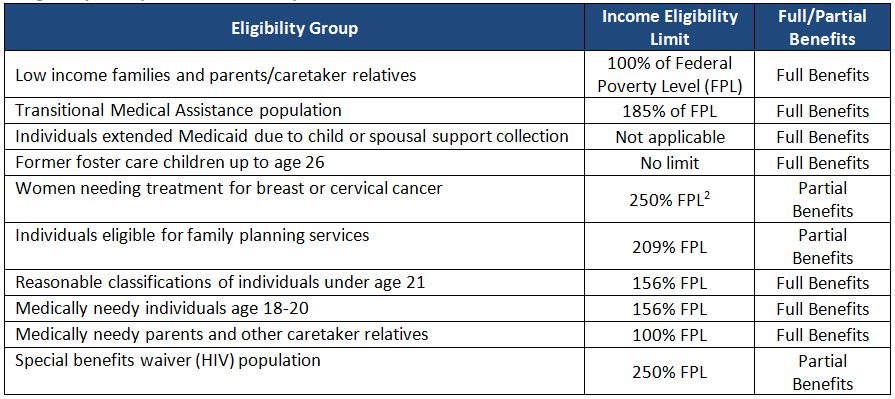

On April 25, 2017, the Maine Department of Health and Human Services released for public comment a draft Section 1115 waiver application to implement new eligibility and coverage requirements for MaineCare, the State’s Medicaid program. The proposed five-year waiver would retain the State’s fee-for-service delivery system, while modifying eligibility requirements and features of coverage for many of the State’s traditional Medicaid populations, including for individuals who do not receive full Medicaid benefits. Maine has not expanded its Medicaid program under the Affordable Care Act and does not provide coverage to childless adults. Eligibility groups that would be included in the demonstration include:

Eligibility Groups Covered in Proposed Demonstration1

Maine is seeking Centers for Medicare and Medicaid Services (CMS) approval for several features that have not been previously authorized—for either expansion adults or traditional Medicaid populations—including:

- Premiums higher than 2% of household income for individuals with incomes below 150% FPL;

- 90-day lockout from coverage for individuals with incomes at or below 100% of FPL who fail to pay premiums in a timely manner and ongoing lock-out for individuals who do not pay past unpaid premiums;

- Participation in work requirements as a condition of Medicaid eligibility;

- Financial penalties for missed doctor appointments; and

- Asset tests for individuals determined eligible under the modified adjusted gross income (MAGI) standard.

According to Maine’s waiver application, the goals of the proposed changes are to:

- Preserve limited financial resources for the State’s most needy individuals and ensure long-term fiscal sustainability;

- Promote financial independence and transitions to employer sponsored or other commercial health insurance; and

- Encourage individual responsibility for one’s health and healthcare costs.

Key features of Maine’s proposed waiver include the following:

Benefits. Enrollees would continue to receive State Plan benefits.

Premiums and Cost Sharing. All enrollees would be subject to sliding scale monthly premiums based on income with the exception of enrollees who are exempt from work requirements (see description below) and Special Benefits (HIV) waiver enrollees. Proposed premium amounts are:

- Individuals with incomes between 0% to 100% FPL: $14 per month

- Individuals with incomes between 101% to 200% FPL: $43 per month

- Individuals with incomes at or above 201% FPL: $66 per month

For many enrollees with incomes below 138% FPL, premiums would be higher than 2% of income—the maximum amount that individuals in this income range would pay on the Marketplace. CMS has not previously approved premiums higher than 2% of income for individuals with incomes below 138% FPL. In addition, based on the waiver draft, it would appear that women eligible for MaineCare on the basis of breast or cervical cancer would be subject to premiums, which is not permitted under federal regulations.

Enrollees who fail to pay premiums within a 60-day grace period would be disenrolled from coverage and subject to a 90-day lockout period. Enrollees would be required to pay all past due premiums before being eligible to reenroll in coverage, meaning the lockout could potentially extend far longer than 90 days for families who are unable to repay between $28 and $132 in previously unpaid premiums.

In addition to continuing to implement current State Plan point-of-service cost sharing, Maine requests a waiver to establish a $20 co-pay for any emergency department (ED) visit that does not result in an inpatient admission. As a result, individuals who visit the ED for emergencies that do not require an admission, such as for broken bones, would be subject to the co-pay. The State would identify these visits through claims data and bill enrollees for the co-pay retrospectively.

Cost-Sharing Cap. The State requests waiver authority necessary to implement proposed ED co-pays and premiums, which would appear to include a waiver of the Medicaid cost-sharing cap of 5% of household income; premiums for enrollees with incomes below 29% of FPL would exceed this limit before accounting for any additional cost sharing. CMS has not previously granted a waiver of the 5% cap for individuals at this income level. States seeking to waive Medicaid cost-sharing requirements must meet the requirements of 1916(f) of the Social Security Act, which limits such waivers to two years for unique and previously untested use of co-pays and only under a stringent set of evaluation requirements.

Financial Penalty for Missed Appointments. Maine seeks authority to permit providers to charge enrollees a financial penalty for missed appointments. The penalty could be up to the amount that the provider charges non-Medicaid patients for missed appointments, as long as that amount does not exceed Medicaid’s expected reimbursement for the scheduled service.

Work Requirements. Maine requests a waiver to require that enrollees meet community engagement and work requirements as a condition of Medicaid eligibility. To meet the community engagement and work requirements, enrollees would be required to complete activities such as working or attaining education for an average of 20 hours per week; acting as a caregiver for an individual with a disability while pursuing training; volunteering for 24 hours per month; or meeting Supplemental Nutrition Assistance Program (SNAP) or Temporary Assistance for Needy Families (TANF) work requirements. Self-employed individuals would be required to work at least 20 hours per week and earn the equivalent of 20 hours of work at the state or federal minimum wage.

All enrollees ages 19-64 would be subject to the work requirements, except those eligible for extended Medicaid due to child or spousal support collections. Populations exempt from the work requirements would include those who are pregnant, participating in a residential substance use disorder treatment program, residing in an institutional residential facility, caring for a young child or disabled dependent, receiving disability benefits, or who are physically or mentally unable to work 20 hours or more per week.3 The State plans to determine exemptions at application and renewal.

The State would disenroll individuals who fail to comply with the work requirements for more than three months during a 36-month time period. Enrollees experiencing extenuating circumstances may receive coverage during a fourth month of noncompliance within that period. In addition, the State would assess whether enrollees had “good cause” for failing to meet work requirements. The process for making such assessments is unclear, but it appears that it would occur prior to disenrollment and would likely require a high level of manual caseworker oversight and intervention. Disenrolled individuals who begin meeting work requirements would be permitted to re-enroll within the 36-month period.

Asset Test. Maine requests a waiver to implement an asset test for all MAGI-eligible enrollees. Enrollees with assets exceeding $5,000 would be considered ineligible for Medicaid.

Waiver of Medicaid Requirements for Annuities. Maine requests authority to charge a transfer penalty when an individual purchases a Medicaid-compliant annuity. In addition, Maine seeks to establish a minimum payout period for Medicaid-compliant annuities. The State would require that payout periods be at least 80% of the annuitant’s life expectancy.

Retroactive Coverage and Prompt Enrollment. Maine requests waivers of Medicaid requirements to provide retroactive coverage and prompt enrollment. Individuals would not be enrolled in coverage until the first day of the month in which they make their first premium payment.

Presumptive Eligibility. Maine also seeks to eliminate hospital presumptive eligibility determinations, except for pregnant women.

Moving Forward

Maine is the second state in as many weeks to release a waiver application seeking new flexibility from the Trump Administration on Medicaid eligibility requirements and coverage features. Maine proposes several features that align with other recent state waiver requests, including work requirements as a condition of eligibility, a waiver of retroactive eligibility, and enhanced cost sharing for non-emergency use of the ED; however, Maine’s proposal is unique in that it would apply only to traditional Medicaid populations, including eligibility groups that do not receive full Medicaid benefits.

As noted above, Maine has requested features that CMS has not previously approved, including premiums higher than 2% of income for populations with incomes at or below 150% FPL, a lockout from coverage for enrollees with incomes at or below 100% FPL who fail to make timely premium payments, and modifications to the cost-sharing cap. Some features of Maine’s proposal may not be able to be waived under current Medicaid law, such as asset tests for MAGI-eligible populations.4

Maine’s application will undergo public comment until May 25, 2017, meaning that it will likely be reviewed by CMS this summer. In the coming months, CMS’s decisions on the pending Arizona, Indiana, Kentucky, Maine and Wisconsin waivers will indicate the degree of flexibility it is willing to grant, providing further insight into its vision for the future of the Medicaid program.

1Maine Department of Health and Human Services, “10-144 Chapter 332: MaineCare Eligibility Manual,” Oct. 1, 2016. Available at: https://www.maine.gov/sos/cec/rules/10/ch332.htm.

2Maine Center for Disease Control and Prevention, “Maine CDC Breast and Cervical Cancer Policy Manual 2017,” January 2017. Available at: http://www.maine.gov/dhhs/mecdc/population-health/bcp/documents/CDC_MBCHP_DIAGPROVManual_1_2017.pdf.

3The waiver application does not list pregnant women as an eligibility group covered under the demonstration, but they are referenced in the application as exemptions with regard to work requirements and elimination of hospital presumptive eligibility.

4Center on Budget and Policy Priorities, “Maine’s Waiver Proposal Would Violate Medicaid Law,” April 26, 2017. Available at: http://www.cbpp.org/blog/maines-waiver-proposal-would-violate-medicaid-law.