Editor’s Note: Healthcare providers are increasingly deploying telehealth capabilities that will extend services to patients in rural areas, provide high-quality care to individuals with complex conditions and reduce costs associated with unnecessary emergency department usage. While telehealth programs deliver significant benefits, they also demand substantial upfront investment in technology, design and staffing. Although payers are increasingly covering telehealth services, receiving reimbursement at a level commensurate with costs continues to be a challenge. To that end, providers need to think beyond reimbursement and understand the potential comprehensive return on investment (ROI) of various telehealth programs.

In a recent webinar, summarized below, Manatt Health shared the characteristics providers need to consider when calculating telehealth’s ROI, the factors driving the dramatic variances in the ROI of telehealth programs and what elements providers should consider when assessing a potential telehealth program’s impact. The program also presented two case studies illustrating Manatt’s framework for estimating the ROI of telehealth programs. Click here to view the full webinar free on demand, download a free copy of the presentation and access the companion white paper.

Findings Vary on the Financial Impact of Telehealth Programs

The literature speaking to the ROI of telehealth is decidedly mixed. It’s possible to find a paper or study to support any conclusion. Some studies show that telehealth saves money and others that it increases costs. The problem with getting a clear answer from current analyses is that the studies are narrow in scope, the data are frequently old and the sample sizes tend to be small. It is difficult to generalize about the ROI of telehealth without understanding the details behind the programs being evaluated, including the specific use case, the clinical area of focus, the type of providers performing the service and the payment environment.

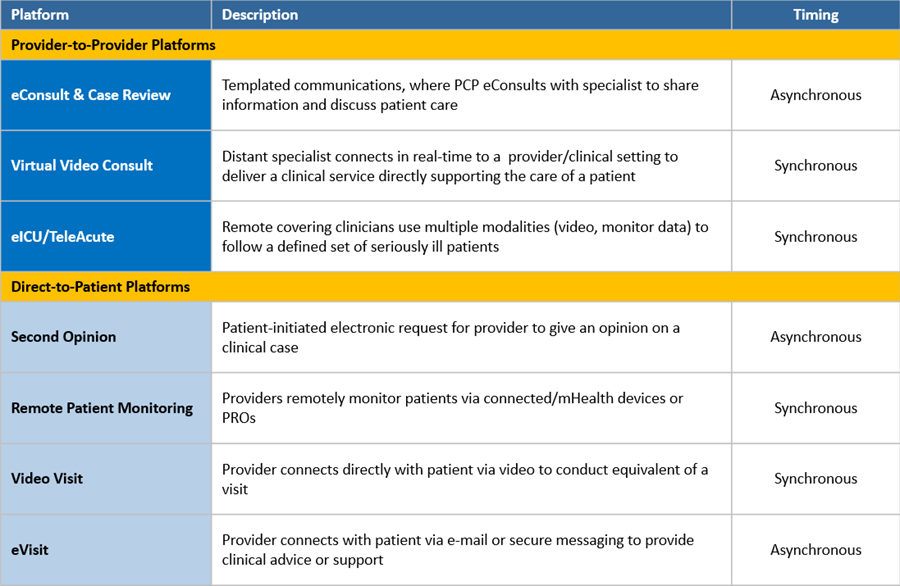

To help develop a more meaningful approach to evaluating ROI, Manatt has created a consistent framework describing different telehealth modalities. (See figure 1.) The top half lists provider-to-provider modalities, such as eConsult, Virtual Video Consult and eICU/TeleACute. The bottom half includes direct-to-patient or direct-to-consumer platforms, such as Second Opinion, Remote Patient Monitoring, Video Visits and eVisits. For each modality, we provide a brief description and whether it is typically performed synchronously or asynchronously.

Figure 1: Framework for Various Telehealth Modalities

The framework is critical, because it provides a common vocabulary through which we can discuss and evaluate the impact of specific programs. While each of these programs falls under the umbrella of telehealth, the value proposition for each in terms of ROI can be very different.

Telehealth Adoption Continues to Proliferate

In spite of mixed evidence on ROI, providers are increasingly investing in and implementing telehealth technology solutions aimed at increasing access to and quality of care. A recent Medicare telehealth report shows continued growth in telehealth utilization among members. The growth is likely due in part to the expansion of various telehealth reimbursement policies relating to eligibility, originating sites, geographic restrictions and other areas over the past few years.

There also has been notable growth among white-label telehealth providers. Teladoc, one of the nation’s leading telehealth providers, has expanded its annual visit volume from 127,000 to 2.6 million visits over a five-year period. Recent findings from FAIR Health and Stanford/Rock Health demonstrate similar trends in increasing patient adoption and utilization of telehealth modalities. FAIR Health found that, among a subset of 29 billion private insurance claims, telehealth grew by 624% from 2014 to 2018. Stanford Center for Digital Health and Rock Health’s recently published annual technology survey found that in 2019, one in four patients used live telehealth technologies.

While provider and patient adoption of telehealth has grown substantially, payers are slower to expand coverage of telehealth services. As a result, providers are struggling to obtain sufficient reimbursement to cover the cost of launching and maintaining telehealth service offerings.

To that end, providers are eager to understand the comprehensive ROI of various telehealth programs. Through Manatt’s extensive work developing telehealth strategies with a variety of providers, we found that, in order to receive institutional budget and buy-in to launch a telehealth program, hospital and provider administrators need to understand the estimated financial impact. Through careful analysis and calculations, we are able to estimate the ROI of a given telehealth program beyond just reimbursement.

ROI Considerations Differ by Provider Type

When we consider the financial impact of a telehealth program, it is essential to take into account the unique organizational characteristics of the healthcare entity implementing the model. There are three major categories of organizational characteristics that we consider when developing an ROI estimate.

The first category is the organization’s size and clinical capacity, including the acuity levels it is able to treat and the services it is able to provide. These factors impact both the operational and financial scale of the program. A larger hospital system that treats higher-acuity patients and provides a wider variety of clinical service offerings would likely experience greater economies of scale and financial impact from a telehealth program than would a smaller provider with more limited service offerings and clinical capabilities.

The second category is the hospital’s payment model—whether it uses a fee-for-service, value-based or mixed approach. Understanding the payer mix has strategic implications for reimbursement. For example, providers using a value-based payment arrangement may be more incentivized to implement telehealth solutions as a way to reduce their overall costs of care. They tend to take on more risks for the sake of improving their population’s health, and they are not as reliant on direct reimbursement as those in a fee-for-service environment.

The third category is the structure of the organization. Is the entity an integrated system in which payers and providers have aligned incentives? Is it a community hospital with limited tertiary care capabilities that could benefit greatly from providing remote access to specialty providers? Is it a physician group with limited resources for substantial upfront investment? It is crucial to understand each organization’s unique structure before starting to evaluate the estimated ROI of a telehealth program.

Principles and Considerations of ROI Modeling for Telehealth

Manatt has identified eight key factors that are critical to consider when estimating the potential ROI of a telehealth program:

1. Patient acuity mix. How will the telehealth program impact the average patient acuity level? How will revenue and costs change as patient acuity levels shift?

2. Cost savings. Will the telehealth program yield cost savings, such as through delivering care in a lower-cost setting?

3. New patient volume. Will the telehealth program increase patient volume?

4. Patient retention. Will the telehealth program result in higher retention rates?

5. Reimbursement or contract revenue. Under which type of payer models are the telehealth services reimbursable? Will the telehealth program bring in other forms of direct revenue?

6 .Technology. What are the hardware and software costs to implement the program?

7. Program management. What are the programmatic costs to design, implement and operate the service?

8. Staffing. What are the staffing requirements for the program? Does the program automate existing tasks to reduce professional costs?

Case Study #1: Rural Community Hospital—Telecardiology Model

Our first case study focuses on a rural community hospital in Virginia that is interested in implementing a telecardiology program. Referring back to the initial telehealth framework in figure 1, the telehealth program it is considering is a provider-to-provider virtual video consult program. The program would connect cardiologists at a local academic medical center (AMC) with emergency department (ED) physicians at the community hospital to discuss diagnoses, observe patients, review records and test results, and recommend treatment plans. The community hospital’s goals are to improve care quality, enhance care convenience and accessibility in community settings, retain patients by reducing avoidable transfers, and attract new patients through enhanced care capabilities.

It is important to note that the first two goals focus on nonfinancial benefits. It is also important to note that both the community hospital and the AMC operate within a fee-for-service payment arrangement.

We start our ROI evaluation by assessing the potential impact of the telehealth program against three major levers for the rural community hospital:

1. Revenue. We anticipate that revenues will increase as transfers decline, new patient inflow increases with the improved ability to provide cardiac services and the hospital treats (and is reimbursed for) higher-acuity patients.

2. Costs. We expect that costs will increase as the community hospital pays for the telehealth service expenses and cares for the newly attracted and retained higher-acuity patients.

3. Margin. We project that margins will increase as the hospital retains more revenue-generating cases.

Next, we evaluate the model’s impact against each of the eight ROI framework considerations. (Please note that any numbers cited are hypothetical proxy values to demonstrate the telehealth program’s estimated impact.)

1. Patient acuity mix. The average revenue of a cardiology case will increase from $16,000 to $16,100, as the hospital becomes able to treat higher-acuity patients.

2. Cost. Costs savings will be limited, as it is more expensive to treat higher-acuity patients. In addition, the hospital may incur some programmatic costs.

3. New patient volume. The new model will help the hospital attract about 100 new patients per year.

4. Patient retention. The new model will enable the community hospital to retain 200 additional cardiology patients per year.

5. Reimbursement or contract revenue. We do not anticipate any direct reimbursement or contract revenue for the community hospital as the AMC, not the hospital, is providing the telehealth consult. The hospital may be eligible for a $20 per consult facility fee from select payers for hosting the teleconsult interaction but, since this fee is nominal, we do not include it in our assessment.

6. Technology. The community hospital will need to invest approximately $10,000 in upfront technology costs to launch the telehealth services.

7. Program. The community hospital will pay the local AMC program approximately $100,000 per year to cover the cost of providing the telecardiology consults, as well as developing any other programs or trainings to support the community hospital’s staff.

8. Staffing. There will be limited impact as there is no need for the rural community hospital to add clinicians or staff to participate in the program. Any staff training costs are included within the program fee charged by the local AMC.

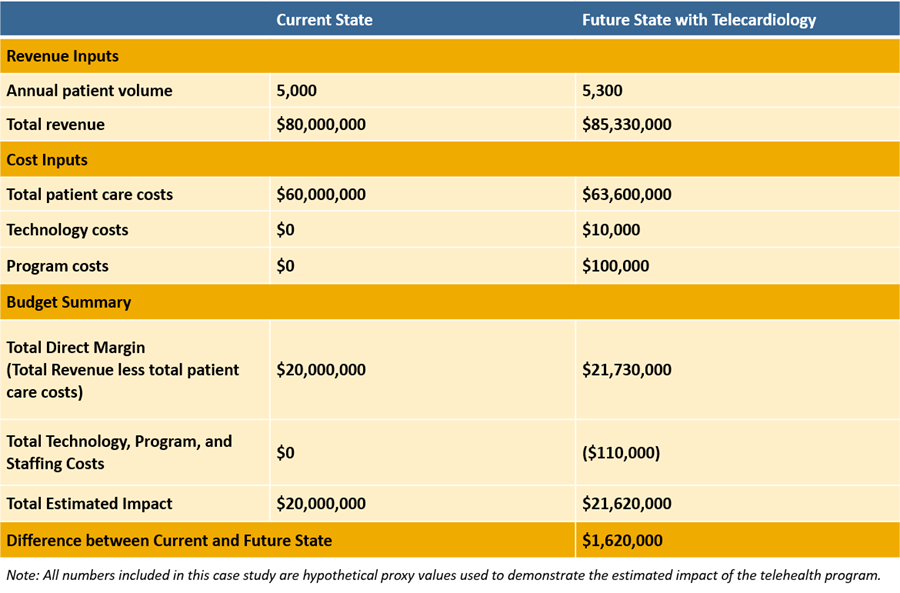

Figure 2 shows a summary of the estimated financial impact of the telecardiology program on the rural community hospital. When we look at the current state (before implementing the telecardiology program in place), we see an expected increase in patient volume, as well as an expected growth in revenue as a result of attracting and retaining higher-acuity patients. We also see costs increase, however, due both to the greater expense of treating higher-acuity patients and the technology and programmatic costs needed to support the telecardiology program. When we compare the differences between the current and future state, we find that the telecardiology program will have an estimated positive impact of $1.62 million. These results are largely the result of increases in patient volume and acuity rather than of new reimbursement revenues.

Figure 2: Case Study #1: Summary of Estimated Financial Impact

Case Study #2: Capitated Hospital—Pretransfer Video Consults

Our second case study focuses on an integrated delivery system that includes several small community hospitals, as well as a flagship tertiary hospital. The community hospitals typically handle lower-acuity issues, while the flagship hospital handles the highest-acuity issues. The health system also owns a health plan and has full-risk contracts with other payers, so it is operating in a fully capitated, value-based payment environment. Therefore, it has a strong incentive to deliver high-value care in the most cost-effective setting, since any unnecessary expense or utilization comes out of its own bottom line.

The telehealth model being considered is a video consult model, which the clinical use cases indicate would reduce avoidable transfers. In this model, clinicians in the EDs of the small community hospitals can consult with specialists not available in the small hospitals rather than immediately transferring patients to the tertiary hospital. The ED physicians in the small community hospitals can connect via live video consult to the system’s transfer center, where specialists can observe the potential transfer patients and determine whether they can be retained or require transfer. If it’s determined that the patient should be transferred, the consulting specialist would know the patient’s condition and be able to communicate proactively with the accepting care team to accelerate time to treatment when the patient arrives.

The program’s goals are to reduce the number of avoidable transfers, strengthen relationships among the system’s hospitals and enhance the quality of transfers between system hospitals. The program also would enable the system to provide care in the highest-value setting and would improve both the quality of care and the patient experience.

In contrast to the first case, which was in a fee-for-service environment, we see no revenue impact in this scenario, since the health system is paid on a capitated basis. On the cost side, we do anticipate decreases due to a reduction in avoidable transfers and the ability to treat patients in the community hospital setting, where the cost structure is significantly lower than in the tertiary hospital setting. As a result, there is a positive impact on margins, as waste is reduced and care is delivered in a more efficient, higher-value setting.

When we assess the telehealth program’s anticipated impact against each of the eight considerations, we see only a negligible impact on patient acuity mix, new patient volume, patient retention, reimbursement or contract revenue. We do, however, see an impact on cost savings, as well as in the areas of investment needed to support the program:

- Cost savings. The average cost per case will decrease from $11,000 to $8,000 for patients retained in a community hospital.

- Technology. The system will need to invest $30,000 in upfront technology costs to launch the program.

- Program. The system will need to invest $60,000 in program design and management costs.

- Staffing. The system will need to invest $50,000 in staff training and additional on-call physician time.

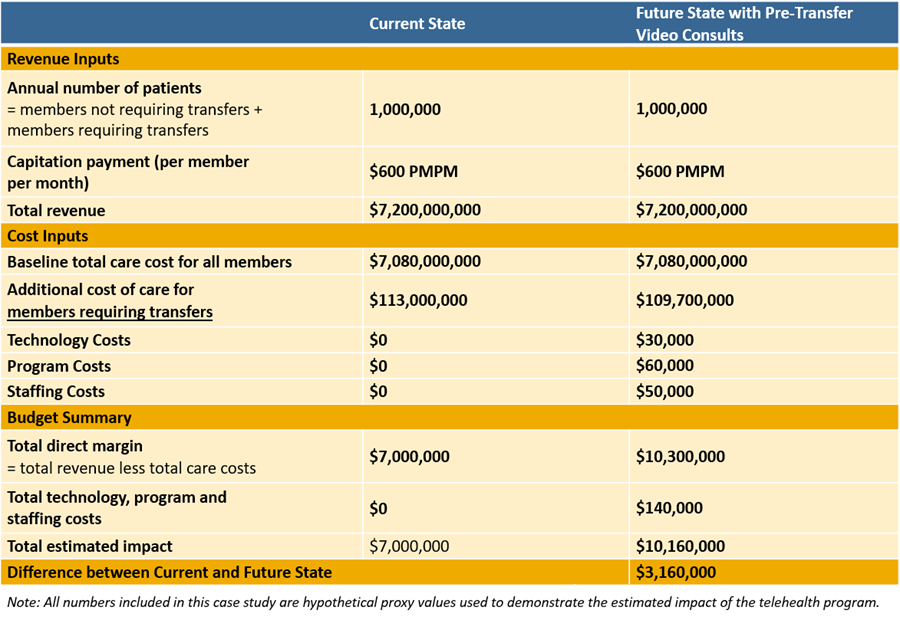

Figure 3 shows the summary of the program’s estimated financial impact, assuming that the system has 1 million covered lives, generating about $600 per member per month, or a little more than $7 billion in annual revenue. Comparing current vs. future state, we see that the telehealth program results in a savings of about $3 million from reduced transfer costs and lower expenses per case. Even factoring in the added program costs, we see a positive financial impact of $3.16 million.

Figure 3: Case Study #2: Summary of Estimated Financial Impact

Conclusions

Providers are leveraging telehealth to optimize care delivery, reach patients in new types of locations, and improve care quality and patient satisfaction. For the time being, the most significant financial benefits from telehealth programs are likely to be the result of changes in patient acuity levels and increases in new or retained patient volume rather than the result of increases in reimbursement. This is a critical finding, because a lot of attention is being focused on reimbursement from a policy and advocacy perspective. In reality, however, the reimbursement potential of telehealth programs is very modest. The real financial drivers are unrelated to reimbursement.

Note: Click here to view our full webinar on estimating the ROI of telehealth programs free on demand, download a free copy of the presentation and access the companion white paper.