High out-of-pocket costs can be a significant barrier to access for Part D enrollees, especially for non-low-income subsidy (LIS) enrollees with a condition that requires an expensive specialty drug for treatment.1 The 2019 Part D defined standard benefit has a $415 deductible and 25% coinsurance up to an initial coverage limit of $3,820 in total drug costs. For total drug costs above that amount while in the coverage gap, Part D enrollees’ out-of-pocket costs for brands have a coinsurance of 25% and for generic drugs 37%.2 After non-LIS enrollees reach the True Out-of-Pocket (TrOOP) threshold and enter the catastrophic phase of the Part D benefit, they still incur 5% coinsurance for each prescription, which can be substantial. Unless changed by legislation, CY 2020 enrollees will experience an increase of $1,250 in the annual TrOOP threshold—from $5,100 in 2019 to $6,350 in 2020—since the reduced annual growth rate in the TrOOP threshold as implemented under the Affordable Care Act (ACA) ends.3 Among the several policy changes being debated as potential ways to reduce out-of-pocket costs in Part D for high-cost enrollees is one that would establish a maximum out-of-pocket (MOOP) cost cap.4

This study estimates the number of non-LIS Part D enrollees in 2017 who would be impacted by establishing a MOOP cap, either at the 2017 TrOOP threshold of $4,950 or above, and the out-of-pocket costs averted by the cap. Our analysis uses 2017 Part D prescription drug event data and excludes enrollees in employer group waiver plans, Programs for All-Inclusive Care for the Elderly, demonstrations and medical savings accounts, as well as all enrollees who are either eligible or enrolled for low-income subsidies.

In 2017 there were 37.7 million Part D enrollees in stand-alone prescription drug plans or Medicare Advantage prescription drug plans.5 Of those enrollees, 24.7 million were not eligible for low-income subsidies (LIS). Among non-LIS enrollees, 790,000 (3.2% of all non-LIS enrollees) had Part D drug out-of-pocket costs that reached the 2017 TrOOP threshold of $4,950, thus entering the catastrophic phase of the Part D benefit.

Out-of-Pocket Costs Above the 2017 TrOOP Threshold

Manatt Health found that:

- Non-LIS enrollees who reached the catastrophic phase incurred total gross drug spending of $17.7 billion in the catastrophic phase alone, of which $832 million (4.7%)6 was paid by enrollee out-of-pocket payments and other third-party payers, including state assistance programs and charities that contribute to an enrollee’s out-of-pocket cost liability.

- For the 790,000 non-LIS enrollees who reach the catastrophic phase of the benefit, average Part D out-of-pocket costs above the TrOOP threshold were $1,053. These out-of-pocket estimates do not include out-of-pocket costs prior to the catastrophic phase.

- Median out-of-pocket costs in the catastrophic phase for non-LIS enrollees was $291; the 75th percentile was $1,062.

- The low median out-of-pocket costs of $291 compared with the higher average out-of-pocket costs of $1,053 reflect that a few Part D enrollees have very high out-of-pocket costs.

- Average out-of-pocket costs in the catastrophic phase for those in the 95th percentile were $4,958, and $8,059 for those in the 99th percentile.

Simulated Maximum Out-of-Pocket Cost Cap

Using Medicare Prescription Drug Event (PDE) data, we followed non-LIS enrollees through the 2017 benefit year to identify those who reached the catastrophic benefit phase, which occurred at a TrOOP threshold of $4,950. Enrollee out-of-pocket payments and manufacturer discount payments in the coverage gap count toward this TrOOP calculation. After enrollees reached the catastrophic phase, we calculated their out-of-pocket costs and other third-party payments7 in the catastrophic phase.

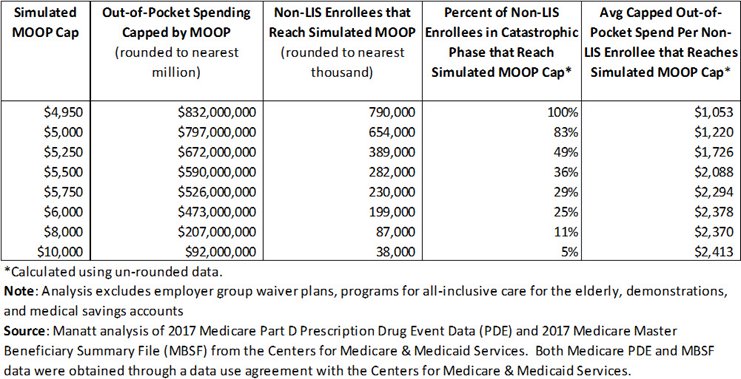

For every simulated MOOP cap, we calculated the total enrollee out-of-pocket costs and other third-party contributions toward those costs that would have been capped by the maximum out-of-pocket limit. As an example, a MOOP cap of $5,000 would reduce out-of-pocket costs by $797 million, or an average of $1,220 per enrollee reaching that cap. Reductions in out-of-pocket costs will need to be financed by some combination of higher payments from the Centers for Medicare & Medicaid Services (CMS), Part D plans, enrollee premiums and manufacturers. Potential changes in prescription drug prices, Part D rebates, premiums and utilization arising from a MOOP cap are not modeled in this study.

Figure 1. Total Out-of-Pocket Costs That Exceed Simulated MOOP Caps for Non-LIS Enrollees (2017)

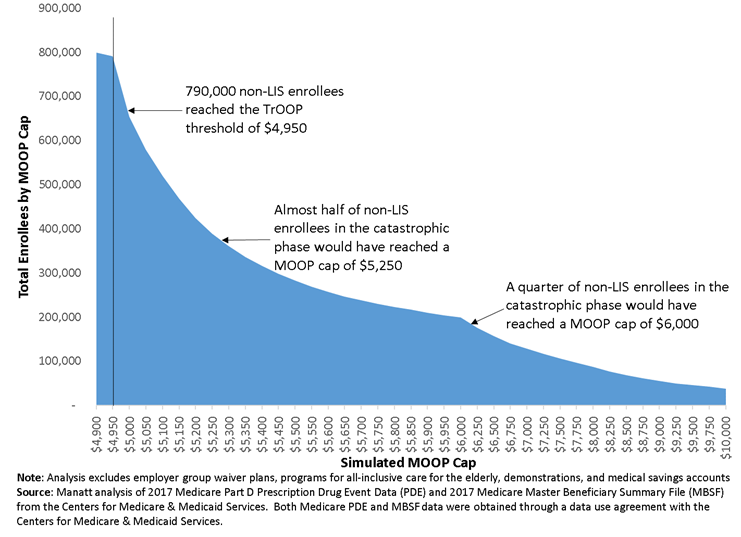

Figure 2 shows total enrollees who would have reached a MOOP cap if it were set at or above the 2017 TrOOP threshold of $4,950. For example, 654,000 non-LIS enrollees (83% of non-LIS enrollees in the catastrophic phase) would have reached a MOOP cap of $5,000, and 199,000 non-LIS enrollees (25% of non-LIS enrollees in the catastrophic phase) would have reached a MOOP cap of $6,000.

Figure 2. Count of Non-LIS Enrollees That Satisfy Each Simulated MOOP Cap in Part D (2017)

Conclusion

A MOOP cap can provide substantial financial benefit to those high-cost enrollees with very high out-of-pocket costs. Depending on where the MOOP cap is set, it will affect enrollees differentially depending on their disease conditions and drug regimens. These benefits will need to be financed by some combination of premiums, payments from CMS or manufacturer discounts.

1 Medicare Payment Advisory Commission. “Report to Congress: Chapter 6: Improving Medicare Part D.” June 2016. p. 170.

2 CMS. “Advance Notice of Methodological Changes for Calendar Year (CY) 2020 for Medicare Advantage (MA) Capitation Rates, Part C and Part D Payment Policies and 2020 Draft Call Letter.” January 2019:55.

3 CMS. “Announcement of Calendar Year (CY) 2020 Medicare Advantage Capitation Rates and Medicare Advantage and Part D Payment Policies and Final Call Letter.” April 2019:64.

4 Medicare Payment Advisory Commission. “Report to Congress: Chapter 2: Restructuring Medicare Part D for the Era of Specialty Drugs.” June 2019.

5 This analysis excludes low-income subsidy enrollees and enrollees in Employer Group Waiver Plans (EGWP), Programs for All-Inclusive Care for the Elderly (PACE), demonstrations and medical savings accounts.

6 Patient liability reductions due to other payers (PLRO) are not included in our estimate of out-of-pocket payments. PLRO payments reduce average enrollee out-of-pocket payments to be slightly less than 5% of total spending in the catastrophic phase. Examples of PLRO include payments by group health plans, government programs such as VA or TRICARE, workers’ compensation, and auto/no-fault/liability insurance.

7 Other third-party payments defined as payments that reduce the beneficiary’s liability that otherwise would count toward the patient’s True-Out-of-Pocket. Examples include payments by qualified state pharmacy assistance programs and charities. Payments by group health plans, worker’s compensation and TRICARE are not included even though they help to reduce the beneficiary liability.