CMS Issues Self-Referral Disclosure Protocol for Stark Law Violations

By Robert D. Belfort, Partner, Manatt Health | Julia Smith, Associate, Manatt Health

On March 28, 2017, the Centers for Medicare & Medicaid Services (CMS) issued a new voluntary self-referral disclosure protocol (SRDP) for disclosing actual or potential violations of the Stark Law. The Stark Law prohibits physicians from making referrals for designated health services (DHS) payable by Medicare to an entity with which the physician (or an immediate family member) has a financial relationship, unless an exception applies. 42 U.S.C. 1395nn(a)(1)(A). The Stark Law also prohibits billing for DHS provided as a result of an improper referral. 42 U.S.C. 1395nn(a)(1)(A) Id.

Background on the Self-Referral Disclosure Protocol

The SRDP was established in 2010 pursuant to Section 6409 of the Affordable Care Act. Section 6409 requires CMS to develop a protocol for self-disclosure of actual or potential violations of the Stark Law and authorizes the agency to reduce the amount owed for such violations. Providers and suppliers self-disclose actual or potential Stark violations under the SRPD with the hope of resolving their potential liability at reduced settlement amounts. CMS determines whether to offer a disclosing entity a reduced settlement and, if so, in what amount, based on a number of factors, including the nature and extent of the violation, the timeliness of the self-disclosure and the entity's cooperation in providing additional information requested by CMS in relation to the disclosure.

Changes Under the New Protocol

The key difference between the previous protocol and the new protocol is that the new protocol requires entities to make their disclosures by filling out and submitting a single set of fillable forms that CMS provides. Under the previous protocol, entities typically provided the information required by the SRDP in the form of a letter. Beginning June 1, 2017, entities must submit disclosures under the SRDP using the forms provided by CMS.1 Entities submitting self-disclosures prior to June 1, 2017 are encouraged, but not required, to use the new forms.

The forms provided under the new SRPD require much of the same information that was required under the previous protocol, including the nature of the violations being disclosed, the entity's history of similar noncompliance, the action the entity has taken to remedy the violation and prevent future noncompliance, and a financial analysis of the potential overpayment.

In addition to mandating use of the forms, the other major changes in the new protocol include requirements to:

- Describe how common or frequent the disclosed noncompliance was in comparison with similar arrangements between the disclosing entity and physicians;2

- Submit a separate physician information form for each physician included in the disclosure, detailing the terms of his or her noncompliant compensation arrangement with the disclosing entity; and

- Use a specific financial analysis worksheet to quantify and report the potential overpayment. The calculation must be based on the six-year look-back period for reporting and returning overpayments in effect as of March 14, 2016. See 42 C.F.R. 401.305(f).

The new protocol is available at https://www.cms.gov/medicare/fraud-and-abuse/physicianselfreferral/self_referral_disclosure_protocol.html.

1 https://www.cms.gov/medicare/fraud-and-abuse/physicianselfreferral/self_referral_disclosure_protocol.html.

2In the protocol, CMS provides several examples of potential descriptions of the pervasiveness of the disclosed noncompliance, such as "The hospital has numerous compensation arrangements with physicians. We estimate that the noncompliant compensation arrangements disclosed herein represent less than 3 percent of all financial relationships with physicians."

back to top

How Will the Trump Administration Impact Healthcare Litigation?

By Joel S. Ario, Managing Director, Manatt Health | Andrew H. Struve, Partner, Co-Chair, Healthcare Litigation

Editor's Note: In a dramatic conclusion to the heated debate surrounding the American Health Care Act (AHCA), the bill was withdrawn after it became clear that House leadership did not have enough votes to pass it. There is much speculation about what will happen next, including pressing questions around whether efforts will ramp up to give states more flexibility and if Affordable Care Act (ACA) taxes will get pulled into discussions on tax reform. In addition, repeal and replace discussions appear to be continuing in Congress and the White House.

Congress also will be taking up other potential vehicles for healthcare change, such as the Children's Health Insurance Program (CHIP) reauthorization. Regardless of any Congressional action, the Trump Administration has significant administrative authority to change Medicaid and ACA implementation. Whatever happens, there could be substantial effects on healthcare law. On March 7, Manatt Health presented a new webinar, summarized below, examining how the new Administration could impact healthcare litigation. Click here to download a free copy of the webinar presentation.

____________________________________

The ACA Executive Order

President Trump signaled his support for dismantling the ACA by issuing an Executive Order on his first day in office. (NOTE: With the withdrawal of the AHCA on March 24, Republicans acknowledged that Obamacare will remain "the law of the land" for the foreseeable future.)

Trump's Executive Order directs federal agencies to minimize regulatory and economic burdens of the ACA but does not issue any new legal authority to make changes to key provisions. To the extent possible, agencies will ease or eliminate ACA requirements imposed on individuals, as demonstrated by the Internal Revenue Services (IRS) reverting back to allowing taxpayers to file tax returns that do not report on coverage status. Agencies must, however, continue to comply with the process requirements of the Administrative Procedure Act, meaning they must follow multiple steps to change any regulations.

Competing Visions for Replacing the ACA

As we saw in the days leading up to the withdrawal of the AHCA, Republicans have competing visions for replacing the ACA. While united on repealing and replacing the ACA, Republicans continue to differ widely on the details and how ACA replacement relates to broader entitlement reform. There are three key factions in both the House and the Senate, though the Senate tends to be a bit more moderate:

- ACA repair-oriented. Supportive of moderate adjustments to the ACA, members of the repair-oriented segment—which includes some Democrats—are proponents of maintaining some ACA provisions and minimizing market disruptions.

- Entitlement reform-oriented. This group—which includes Speaker of the House Paul Ryan and Secretary of Health and Human Services (HHS) Tom Price—is supportive of wholesale replacement of the ACA but mindful of political consequences. Its members are seeking broader action on entitlement reform across public programs, such as Medicaid, Medicare and the Marketplaces.

- Budget-oriented. The budget-oriented faction—which includes the Freedom Caucus—views ACA repeal as a short-term imperative and members are strong advocates for aggressive entitlement reform and reduced federal spending.

Medicaid Administrative Actions: New Waiver Requests Expected

Before the ACA, there were a number of waivers granted by the Obama Administration. These past waivers:

- Gave states flexibility to charge premiums as long as they were no more than 2% of income.

- Allowed cost sharing in the Medicaid population, somewhat similar to what was allowed in the Marketplaces.

- Provided for health savings accounts and in some states, such as Indiana, wellness behavior incentives.

- Allowed work referrals but not the requirement for people to have a job as a condition of receiving Medicaid insurance.

- Permitted benefit and coverage changes, such as premium assistance for people to buy into the Marketplace, which Arkansas and New Hampshire put into place. Several states also tried using premium assistance to combine Medicaid coverage with employer-based coverage.

Going forward, there are likely to be more Section 1115 waivers. Upcoming proposals may include:

- Charging premiums above 2% of income.

- Losing coverage for non-payment of premiums for those at or above 100% of the federal poverty level (FPL).

- Locking people out for nonpayment of premiums. (Indiana has a six-month lockout for those who fail to pay their premiums. New waivers may go beyond that.)

- Putting restrictions on eligibility, such as work requirements, time limits on benefits, and enrollment caps.

- Locking people out for failure to renew eligibility.

- Allowing states to limit formularies, decide whether to cover new drugs and exclude some FDA-approved drugs from formularies.

The Patient Freedom Act

Introduced in January [prior to the AHCA] by Senators Bill Cassidy (R-LA) and Susan Collins (R-ME), the Patient Freedom Act could be viewed as a default position to repeal and replace. It is a complex proposal that gives states three options—all of which include the flexibility to pursue waivers or actions under state law:

- Option 1: ACA Preservation permits a state to preserve the ACA as it is today, except that the aggregate value of the subsidies cannot exceed the value of the federal subsidies the state would have received under Option 2 (below).

- Option 2: State Alternative provides Health Savings Account (HSA) credits to individuals enrolled in commercial coverage and ineligible for other federally-funded programs. HSAs may be used to fund medical care expenses, including premiums and cost sharing. The total federal subsidy is 95% of premium and cost-sharing subsidies available to a state's individual market enrollees. The subsidy is increased for states that do not adopt Medicaid expansion.

- Option 3: ACA Rejection allows states to pursue their own approaches to coverage, without federal funding.

Medicare: The Political Third Rail

Many Republicans support fundamental changes to Medicare. Medicare, however, is the political third rail, making short-term changes in legislation unlikely. We don't foresee any changes in Part D benefits nor do we anticipate payment cuts for providers.

There may be some administrative changes. The CMS Innovation Center will most likely continue, perhaps with more voluntary experiments. If Medicare reaches a certain spending level, the Independent Payment Advisory Board (IPAB) is likely to be triggered, initiating spending restrictions.

Employer-Sponsored Coverage: The Most Stable Healthcare Market

The employer market—which covers more than half the country—is the most stable, so any changes will be carefully considered to avoid disruption. Both the employer and individual mandates are likely to be repealed, with minimal impact on coverage The "Cadillac tax"—unpopular with both Republicans and Democrats—has been delayed for another five years.

Some changes to insurance reforms, such as eliminating annual limits, could affect employer coverage. Young adult coverage—allowing people to stay on their parents' insurance until age 26—is likely to remain in place, but the primary impact is on the individual market. Finally, the Republicans favor longer-term changes that will equalize the tax advantages for individual and group insurance. Equal taxes for group and individual insurance is going to continue to be a major issue.

What May Happen Next?

With the AHCA withdrawn, one possible scenario would be for Republicans to mimic the repeal bill they passed in 2015 that was vetoed by then-President Obama. In this scenario, Republicans would use the budget reconciliation process to address pressure points, including repealing the individual and employer mandates; premium and small business tax credits; cost-sharing reduction payments to insurers; Medicaid expansion for adults earning less than 138% of FPL; and taxes on individuals, insurers and providers, including the "Cadillac" and medical device excise taxes.

Increased Lawsuits Stemming from Reduced Medicaid Funding

We are likely to see cost controls of some type on future Medicaid spending, most likely in terms of per capita funding—capped funding on a per-enrollee basis, with potentially different caps for certain groups, such as children or the disabled. There already is disparity between states that have robustly expanded their Medicaid programs and states that have staunchly resisted expansion—and block funding would result in even starker differentiation.

If Medicaid expansion is repealed, there is an open question as to what the government's funding liability will be to states that have made significant expenditures expecting substantial financial support from the federal government. That question may play out in court, the political arena or both.

Medicaid providers, particularly hospitals, are most likely to be the litigants, given their interest in reducing uncompensated care rates. There is also the possibility that beneficiaries will bring suit, alleging that their entitlements were diminished without due process of law. As Medicaid funding becomes more limited, states may try to limit their coverage pools—such as by capping enrollment or increasing cost-sharing—which also could be the subject of beneficiary suits, alleging that these restrictions disproportionately impact some groups more than others.

Where Do Insurance Companies Stand on Repealing the Individual Mandate?

Insurers generally have taken the position that the individual mandate is critical to their ability to provide benefits. Any proposals are likely to include the requirement to continue coverage for preexisting conditions and to keep people on their parents' plans until they are 26. But it is unlikely that they will force people to buy coverage if they don't want it. If this is the scenario that comes to pass, litigation seems likely, given the financial stakes for insurers.

Repeal Could Decrease Employee Lawsuits

One of the most hotly litigated issues under the ACA is the requirement for employers to provide preventive contraceptive services without cost-sharing to the employee. This requirement is not imposed by statute or regulation but is on a list administered by the HHS's Health Resources and Services Administration (HRSA). The Trump Administration can simply remove contraceptive services from the list, and there would no longer be an issue.

The broader question is whether an employee has a right to these services under other provisions of law, such as under the Employee Retirement Income Security Act (ERISA). Even if no federal law applies, there are plenty of state laws that provide cause of action. Contraception is unlikely to go away as an issue, but suits may be framed in different ways.

Repeal Could Drive Contractual Litigation

Contractual litigation will likely arise in the event repeal does ultimately happen, because underlying agreements may not have anticipated repeal. Examples are litigation between states and contractors, if states dismantle their exchanges and litigation from contracts (such as shared risk agreements) that took the continued existence of the ACA as an implicit promise of the agreement.

What Would Happen to Prior Lawsuits?

Once a case has been decided and the appeal, if any, has been satisfied, the decision is law and would not be affected by complete or partial repeal. If there were a repeal of the ACA, these cases would most likely become historical footnotes. They would become moot, once the relevant provision of the ACA was repealed, though they could serve as precedent in other cases.

Status of Ongoing Lawsuits Regarding ACA Implementation

There is a statute under federal law requiring state Medicaid plans to provide networks and payments that are sufficient to enlist enough providers to offer an equivalent level of care and services as is available to the general population in the same geographic area. If some form of block grants or per capita caps were enacted, there could be litigation alleging that reducing Medicaid payments resulted in providers no longer being willing to enroll in the Medicaid program, and therefore, that the number of providers is insufficient to provide care.

This is an argument that has been tried before in California and the Supreme Court, which determined that there was not a right of action on the part of beneficiaries and providers to litigate against state spending cuts to the Medicaid program. Therefore, this approach is unlikely to succeed, though we could see it come up again in the litigation context.

Status of the Section 1557 Prohibition Against Discrimination Based on Gender Identity or Termination of Pregnancy

Section 1557 of the ACA prohibits discrimination on the basis of gender identity or termination of pregnancy. On December 31, 2016, Judge Reed O'Connor issued an order granting a preliminary injunction preventing the government from enforcing the prohibition in the Final Rule on Nondiscrimination in Health Programs and Activities, 81 Fed. Reg. 31376 (May 18, 2016), against discrimination on the basis of gender identity or termination of pregnancy.

The preliminary injunction is currently under interlocutory appeal to the Fifth Circuit. (The appeal was initiated by the American Civil Liberties Union (ACLU) and the River City Gender Alliance, not by the government.) If Section 1557 is repealed, the decision becomes moot.

If gender identity protection under Section 1557 were to go away, there's nothing to stop a state from taking over that protection. A state could technically just paste Section 1557 into its own code.

A number of states—including California, New York and Massachusetts—already have enacted laws and/or policies providing that denials of coverage for treatment of gender identity disorder may be discriminatory. It is likely that litigation on this issue will proceed at the state level.

The same holds true for contraception, with states willing to step in to ensure coverage, even if a replacement bill does not. California, Maryland, Vermont and Illinois already have codified the contraceptive mandate in state law, and New York, Minnesota, Colorado and Massachusetts are pursuing similar measures.

The Outlook for Pharmaceutical Litigation

Based on the significantly increased value of pharmaceutical stocks after President Trump's election, many have speculated that the industry stands to gain more from a Trump presidency than it would have from a Clinton presidency. Therefore, the possibility of litigation seems lower than for other constituencies. On the other hand, President Trump has criticized the pharmaceutical industry on issues such as rising prices. It remains to be seen whether we will see any changes in pharmaceutical litigation. On the litigation side, the biggest impact on any business may well be how it relates to this Administration and whether it falls in or out of favor.

Conclusion

Whatever changes may come, stakeholders are hoping they will be both gradual and predictable. When asked if they are going to participate in the Marketplaces in 2018, many insurers have said that their decisions will be based on whether the situation has begun to settle down and be more predictable. If changes are happening that they can't anticipate, they are more likely to be risk averse. It is important for Congress and the White House to understand that they can't keep everything unsettled for too long without causing real disruption in the market.

back to top

PBMs Emerge as New Partners in Drug Discount Programs

By Sandy W. Robinson, Managing Director, Manatt Health | Jill DeGraff, Partner, Manatt Health

Editor's Note: Central to a growing debate around drug pricing (highlighted during our last election cycle) is how to meet the challenge of controlling rising drug costs while ensuring patients have access to needed medications. Several entities within the U.S. pharmacy distribution and reimbursement supply chain have been criticized for contributing to the problem—among them, pharmaceutical manufacturers and pharmacy benefit managers (PBMs). Both are subject to legal and regulatory guidelines that place guardrails on their respective business models.

Within this context, in the article below, Manatt Health examines the growing trend of PBMs establishing direct-to-consumer drug discount programs, compares and contrasts the legacy and emerging patient support and drug discount programs, and contemplates possible reasons why PBMs are emerging as new partners in this arena. Specifically, PBMs may be developing a more comprehensive menu of consumer-oriented services as a hedge against cost pressures and an opportunity to leverage their unique role in the supply chain.

____________________________________

In December 2016, Express Scripts and Eli Lilly announced a partnership with digital health start-up Blink Health to offer uninsured patients with diabetes a 40% discount on select Eli Lilly insulin products through a "novel quality-based pharmacy network." In March 2017, CVS Caremark and Novo Nordisk announced a direct-to-consumer prescription savings program for three Novo Nordisk insulin products. Patients using the CVS-branded Reduced Rx program pay the cost of the discounted medication completely out-of-pocket (cash-paying patient), and forego using their prescription drug insurance coverage, if they have any. Express Scripts and CVS Caremark join OptumRx, which already runs a prescription discount program for AARP members and their families. The program offers discounts on medications that are not covered by the patient's current prescription insurance or Medicare Part D plans.

The slight nuances among these programs depend on the patient's drug insurance coverage status—uninsured (Express Scripts/Eli Lilly/Blink Health program), cash-paying who do not use their insurance coverage (CVS Caremark/Novo Nordisk program), or the underinsured (OptumRx AARP program). The moves are consequential to the PBM market and future prescription drug pricing, because Express Scripts, CVS Caremark and OptumRx capture over 70% of the PBM market.

Legacy of Patient Assistance Programs

The PBM drug discount programs share some common characteristics with the patient assistance programs that pharmaceutical manufacturers and some charitable foundations have maintained for decades. Legacy programs fall into one of three categories: patient assistance programs (PAP), copayment support programs and charitable foundation patient support.

- Patient Assistance Programs. PAPs are pharmaceutical manufacturer-sponsored programs for the uninsured and, in some cases, the underinsured. Pharmaceutical manufacturers make drugs available at no charge to patients who meet income and other eligibility requirements.

- Copayment Support Program. Copayment support programs are pharmaceutical manufacturer-sponsored programs for commercially insured patients. These programs reduce copayments for a drug to a fixed-dollar amount per 30-day (or in some cases, 90-day) supply or a percentage of cost, subject to a maximum amount. Beneficiaries in federal or state health programs are ineligible for this type of copayment support.

- Charitable Foundation Patient Support. These programs are offered by 501(c)(3) charitable organizations to provide support to patients with specific diseases and may include beneficiaries in federal or state health programs. The types of support vary greatly, and patients must submit applications to receive assistance.

There are several characteristics, summarized below, that emerge when comparing legacy patient support programs to emerging direct-to-consumer drug discount programs.

- Sponsorship. While pharmaceutical manufacturers continue to offer traditional patient assistance programs, they are also partnering with PBMs to offer direct-to-consumer drug discount programs.

- Patient Eligibility. Both legacy patient support programs and the emerging direct-to-consumer drug discount programs are making the programs available to the uninsured and underinsured. Some drug discount programs are available to cash paying patients even if they have insurance, as long as they agree to forego insurance to use the program.

- Source of Funds. Pharmaceutical manufacturers fund their PAPs and copayment assistance programs internally while 501(c)(3) organizations rely on charitable contributions to fund their patient support programs. The source of funding for PBM-sponsored drug discount programs remains unclear.

- Fraud and Abuse Considerations. Beneficiaries under federal or state public health programs are excluded from pharmaceutical manufacturer-sponsored copayment support programs to avoid violating federal (and possibly state) fraud, waste and abuse laws. Charitable foundations face similar risks, especially since pharmaceutical manufacturers are among their donors. While PBMs are not immune from these prohibitions, they may be better positioned than pharmaceutical manufacturers to meet the criteria of beneficiary inducement safe harbors established under the Affordable Care Act.

- Political Context. Legacy patient support programs have existed for decades. They were developed as strategies to improve access to needed drugs while extending the marketability of certain drugs at or near the end of their patents' lives. Today's political context concerning prescription drug prices is considerably more volatile. Both pharmaceutical manufacturers and PBMs are in a defensive posture with regard to drug price increases.

- Growth Strategy. PBMs not only face pressure to reduce drug pricing, they face the possibility of assuming increased risk in value-based arrangements in the future. For this reason, PBMs need to create a means of engaging consumers more directly. Establishing a drug discount program may be low-hanging fruit for a more ambitious long-term consumer engagement play.

Conclusion

Both pharmaceutical manufacturers and PBMs will increasingly look for ways to engage patients and reduce costs through better management of chronic diseases. PBM-sponsored prescription drug discount programs represent a first step toward a more direct and potentially more comprehensive direct-to-consumer platform that complements their direct relationships with payers, pharmaceutical manufacturers and pharmacies. The strategic and legal implications of designing and operating these programs are significant for PBMs and other market participants.

back to top

New Webinar: How Will Healthcare M&A Change Under the Trump Administration?

Join Us April 27 from 3:00–4:30 p.m. ET for "Mapping the Healthcare M&A Landscape Under the New Administration."

The healthcare M&A market continues to be among the most active sectors. In 2016, there were 939 healthcare industry deals in the U.S. with an aggregate value of approximately $71.7 billion.

How will the policies and goals of the new administration likely impact healthcare M&A trends? How will changes in the regulatory landscape affect M&A across all healthcare stakeholder segments? What can you expect to see in terms of antitrust regulation and enforcement? Manatt addresses these and other key questions in a new webinar for Bloomberg BNA. The session will:

- Share an up-to-the-minute look at the status of Affordable Care Act (ACA) repeal and replace/repair efforts in Congress and the Executive Branch—and the implications of various scenarios on the healthcare sector.

- Analyze the conflicting policy goals and political dynamics driving the debate around the ACA.

- Review the changing landscape, critical issues and key takeaways for payer transactions in the wake of the failed insurance megamergers.

- Examine hospital M&A and antitrust trends, including how the current climate might affect hospital transactions.

- Explore the issues around forming and operating Accountable Care Organizations(ACOs).

- Reveal the latest trends in state-action antitrust immunity for healthcare transactions.

- Anticipate how healthcare antitrust enforcement may change with a new administration.

- Present an update on regulatory and private antitrust activity in pharmaceutical pricing and pay-for-delay settlements.

Presenters:

Joel Ario, Managing Director, Manatt Health

Lisl Dunlop, Partner, Co-Chair, Antitrust and Competition

Tom Leary, Partner, Corporate and Finance

Eric Newsom, Partner, Chair, Corporate and Finance

back to top

Deceptive Claims in Healthcare: Takeaways From the ULIC Settlement

By Richard P. Lawson, Partner, Consumer Protection | Joel S. Ario, Partner, Manatt Health

To the wealth of issues confronting the insurance industry with the new Trump Administration, we can add the old and established concerns about deceptive advertising. Using the Massachusetts law prohibiting unfair and deceptive acts or practices (UDAP), Attorney General Maura Healey recently reached a settlement with health insurer United Life Insurance Company (ULIC) for offering plans that did not meet federal and state coverage requirements. Channeling the unfair competition aspects of the UDAP law, Massachusetts accused ULIC of "siphoning consumers out of the Massachusetts health insurance market" by deceptive claims about the breadth and cost of its short-term medical insurance policy.

The complaint alleged a mixture of violations stemming from traditional deceptive claims to failure of the plans to live up to statutory requirements. In the realm of traditional advertising compliance, Massachusetts accused ULIC of deceptively marketing that its plans covered mental health treatment and provided prescription coverage, as well as misrepresenting plan costs. Further, Massachusetts alleged that agents of ULIC falsely claimed that they were connected with the Massachusetts Health Connector Authority and that their plans were half the price of competitive plans but offered similar coverage.

Allegations of Failing to Live up to Coverage Requirements

As to ULIC's failure to live up to the Massachusetts statutory requirements for coverage, the Attorney General made several allegations. As a preliminary matter, the Attorney General claimed that ULIC sold its plans without first filing them with the Massachusetts Division of Insurance and securing the approval of the Commissioner of Insurance. Further, the Attorney General claimed that the plans failed to include coverage for mental health, maternity and diabetes services. ULIC's plans were alleged to exclude consumers due to preexisting medical conditions, and also to deceive consumers into thinking they were securing plans that satisfied state and federal mandates for insurance.

The Settlement: Requirements, Lessons and Issues

The settlement will require ULIC to come into compliance with Massachusetts law for health insurance plans offered in the state. Most dramatically, however, ULIC will have to make payments totaling more than $2.8 million dollars: $450,000 for penalties to the Massachusetts Attorney General, $15,000 for costs and $2.3 million to make whole consumers who had been denied payments for the shortcomings in coverage that the Attorney General identified.

This settlement is a reminder that traditional notions of deceptive claims apply in any consumer- facing industry, even one as heavily regulated as healthcare. A common truism of deceptive advertising is that the first victim of a deceptive claim is the competitor who did not engage in that type of advertising. Attorney General Healey's complaint alleging that ULIC siphoned off healthy consumers is indicative of the central purpose of UDAP law—to ensure a fair marketplace for both consumers and competitors.

Of course, given the current political climate, this settlement naturally raises issues that will be at play in the coming debates over healthcare policy. In the press release for this case, Attorney General Healey stated that:

Recently revived federal proposals to take away our state's longstanding authority to oversee sales of health insurance will leave consumers and families more vulnerable to exploitation and create a 'race-to-the-bottom' that will raise prices and reduce access to quality healthcare for those in need.

Conclusion

During the Obama years, many Republican attorneys general brought policy-based suits against the federal government asserting states' rights issues. Many have predicted that Democratic attorneys general may emulate those practices, particularly if the Trump Administration and Congress pursue federal reforms, such as interstate sales of health insurance and federally certified association health plans (AHPs), that preempt state law and tie the hands of state regulators.

At a time when the Trump Administration is pursuing major changes to the Affordable Care Act that would return more responsibility for health insurance regulation to the state level, there may even be bipartisan opposition to AHPs and other federal preemptions of state consumer protection laws. Indeed, the National Association of Insurance Commissioners (NAIC) has consistently opposed AHPs, interstate sales and other federal preemption on a bipartisan basis.

back to top

Medicare Telehealth Coverage: Signals Point to Imminent, Data-Driven Policymaking

By Jill DeGraff, Partner, Manatt Health

Editor's Note: Recognizing the surge in telehealth usage and the legislation governing it, Manatt Health will present a monthly series of articles exploring telehealth topics. Upcoming subjects include:

- A clinical perspective of evidence used to support Medicare telehealth coverage expansion

- A side-by-side comparison of telehealth bills presented during the 114th and 115th Congressional sessions

- A review of existing telehealth waivers granted in the Medicare Shared Savings Program (MSSP) and Center for Medicare and Medicaid Innovation (CMMI) models

- An update on the implementation of the Interstate Medical License Compact

We kick off the series with the article below looking at Medicare telehealth coverage and the consistent signals about the need to change coverage policy based on data-driven evidence.

____________________________________

The Agency for Healthcare Research and Qualty (AHRQ) published a Federal Register notice announcing that it is conducting a systematic review of the use of Telehealth for Acute and Chronic Condition Consultations, and is seeking the public's help in identifying scientific information that is not in the published literature. This is the latest in a series of data-gathering predicates to federal telehealth policymaking. The deadline was April 24, 2017 for interested parties who wish to identify comparative studies for AHRQ's systematic review.

AHRQ's Data Request

Submissions responding to AHRQ's data request should identify comparative studies that can address key questions described in the project's research protocol. The key questions for the systematic review and some of AHRQ's related guidance include:

- Are telehealth consultations effective in improving clinical and economic outcomes?

- Are telehealth consultations effective in improving intermediate outcomes?

- Have telehealth consultations resulted in harms, adverse events or negative intended consequences?

- What are the characteristics of telehealth consultations that have been the subject of comparative studies?

- Do clinical, economic, intermediate or negative outcomes vary across telehealth consultation characteristics?

In a subsequent research phase, AHRQ will develop a decision model to help policymakers predict the impact on clinical, economic and intermediate outcomes of telehealth consultations and the effect of various proposed payment reforms on these outcomes.

Bipartisan and Nonpartisan Support Grows for Modifying Medicare's Telehealth Payment Restrictions

Modifying Medicare's telehealth payment restrictions has wide bipartisan support. In their confirmation hearings, both Department of Health and Human Services (HHS) Secretary Tom Price, MD and Centers for Medicare and Medicaid Services (CMS) Administrator Seema Verma expressed support for telehealth expansion. In addition, Congress last year passed the 21st Century Cures Act, which was signed into law with bipartisan support in December 2016. The Act includes a directive that CMS and the Medicaid Payment Advisory Commission (MedPAC) deliver information by December 2017 and March 2018, respectively, that will be pertinent to policymaking on Medicare telehealth coverage reform.

Specifically, Congress directs CMS to provide information concerning Medicare and Medicaid populations whose care may be improved most by telehealth expansion, CMMI models or other initiatives that have examined the use of telehealth, high-volume services that might be suitable for delivery via telehealth, and barriers that prevent expansion of telehealth services beyond those already covered in the Medicare program. Congress also directs MedPAC to conduct quantitative and qualitative analyses that identify gaps in coverage between Medicare fee-for-service (FFS) and private health insurance plans, and to make recommendations for adding coverage under Medicare FFS programs for telehealth services that are covered under private plans.

AHRQ's systematic review of available scientific information will further CMS's and MedPAC's information-gathering efforts by addressing perceived shortcomings in available peer-reviewed research. For example, in its June 2016 report to Congress, MedPAC encouraged more targeted research on telehealth to be done to examine quality, outcomes and cost reductions with specific patient populations. In a draft report released in December 2015, AHRQ called for more validation of telemedicine's effectiveness to guide policy decisions by focusing on specific telehealth interventions, especially under different payment models.

Ultimately, policymakers will need evidence demonstrating that expanding Medicare telehealth coverage would reduce federal spending, since:

- Legislative policymaking will need to be scored by the Congressional Budget Office for impacts on federal spending.

- Administrative policymaking is subject to regulatory caps established by executive order signed by President Trump on January 30, 2017. For the balance of fiscal year 2017, whenever a federal agency proposes a new regulation, it also must identify two existing regulations for repeal, for a net regulatory savings or, at most, zero-cost change.

Telehealth Waivers in CMMI Models

The Center for Medicare and Medicaid Innovation (CMMI) has issued limited waivers that modify Medicare's telehealth payment rules for Next Generation Accountable Care Organizations (ACOs) under the Comprehensive Joint Replacement Payment Model by:

- Waiving geographic site requirements,

- Waiving most originating site requirements, and

- Permitting in-home telehealth visits.

Similar waivers are contained in final rules for Episode Payment Models and the Cardiac Rehabilitation Incentive Payment Model.

The Administration's posture toward telehealth may be revealed by changes it chooses to make—or not make—to any of these models. CMS has delayed the effective dates for the Episode Payment Models and Cardiac Rehabilitation Incentive Payment Model until May 20, 2017, and may delay them further. Federal policymakers may be particularly receptive to scientific information that allows CMMI to project savings or budget neutrality for targeted telehealth interventions furnished during the episodes of care in question—namely, surgery for hip or femur fractures, coronary artery bypass surgery, heart attack or cardiac rehab.

Conclusion

Federal policymaking bodies are sending consistent signals about the need to change Medicare's fee-for-service telehealth coverage policies based on timely and reliable evidence. They seem aligned in recognizing that policy barriers are inhibiting more rapid implementation of telehealth. Healthcare providers and other telehealth stakeholders with credible scientific information may wish to capitalize on this inflection point in federal policymaking to advance their proposals for reforming Medicare's telehealth payment rules.

back to top

The DOJ's Case Against North Carolina Anti-Steering Agreements Permitted to Proceed

By Lisl J. Dunlop, Partner, Litigation | Shoshana S. Speiser, Associate, Litigation

The Department of Justice's (DOJ) case against Carolinas Healthcare System's (CHS) anti-steering contract clauses has survived initial attempts by CHS to dismiss the case. Despite the reversal of the DOJ's win in the American Express case late last year (which addressed anti-steering provisions in AmEx merchant contracts), the DOJ will have the opportunity to conduct discovery and develop evidence of the competitive impact of the CHS anti-steering provisions on healthcare markets in Charlotte, North Carolina. The CHS case could have important consequences for the ability of health insurers to develop and promote narrow networks, tiered models and other innovative products in markets with large, significant provider systems.

The use of tiered or narrow networks offered in exchange for lower premiums and/or copays has emerged as a means for insurers to incentivize consumers to utilize lower-cost providers, which arguably promotes competition in hospital markets and ultimately may control healthcare costs. As discussed in a previous Health Update article, the DOJ and the North Carolina Attorney General sued CHS in June last year, alleging that CHS exercised its market power by insisting on contract terms that prevented major insurers from steering patients to lower-cost hospitals.

CHS's contract terms restrict insurers' ability to exclude CHS hospitals from narrow networks or to incentivize patients to use CHS competitors in tiered networks. CHS's contracts also prevent insurers from providing information to enrollees about the cost and quality of healthcare services provided by CHS and its competitors. CHS was able to obtain these terms, according to the DOJ, due to the fact that its market share exceeds 50% in the Charlotte, NC region.

CHS sought to obtain a judgment on the pleadings, arguing that its anti-steering provisions had the procompetitive effect of ensuring access to a broader patient population, and that the DOJ had failed to allege any anticompetitive harm from the provisions. CHS's arguments were boosted late in 2016 when the DOJ's earlier win in the American Express case was overturned on appeal. CHS argued that the Second Circuit's finding that AmEx's nondiscrimination provisions (which prevented merchants from steering customers to forms of payment that cost less for merchants to accept) were not anticompetitive also should apply to the CHS anti-steering provisions.

The Decision Held That CHS's Anti-Steering Clauses Can Violate Antitrust Laws

Last month, Judge Robert J. Conrad, Jr. held that the DOJ had sufficiently alleged that CHS's use of anti-steering clauses can violate the antitrust laws. United States of America v. Charlotte-Mecklenburg Hosp. Authority, Case No. 3:16-cv-00311 (W.D.N.C. Mar. 30, 2017). In his decision, however, Judge Conrad stressed the DOJ's relatively light burden at this early juncture in litigation. He emphasized that the DOJ was not yet required to actually prove competitive harm, only to make allegations that (if true) would cause such harm. The Court acknowledged that CHS had "raised serious and robust questions about the purposes, effects and legality of its contractual steering restrictions and steering restrictions generally," but noted that those questions could not be resolved fully until after full discovery.

Judge Conrad resisted CHS's assertions that the American Express case was in any way controlling in the CHS case. First, coming from a different judicial circuit, the decision is not binding on the North Carolina court. Second, the American Express case was fully developed and went through a seven-week bench trial at which detailed evidence was presented and tested, so it could not be compared to CHS's motion for judgment on the pleadings before discovery. Finally, and possibly most importantly, although American Express considered provisions that were aimed to prevent customer steering, the healthcare industry is very different from the credit card industry, and the competitive dynamics and impacts will necessarily be different.

In the credit card industry, the Second Circuit found that customer loyalty resulted from competitive benefits rather than from market power; credit card companies had a "legitimate interest" in restricting steering; and steering posed "no monopolistic danger." The American Express opinion did not address whether customer loyalty in the healthcare field is evidence of market power that permits a hospital to unilaterally increase prices.

Conclusion

Despite distinguishing the healthcare industry from the credit card industry, the Court still stressed that CHS may have procompetitive justifications for its restrictions and that the DOJ had not yet proved its case. Further, the DOJ is still considering whether to appeal the American Express decision to the Supreme Court, so there may be a further opportunity for developments on the legality of anti-steering provisions under the antitrust laws. For now, hospitals and insurers should continue to monitor the CHS case, which may have broad implications for the degree to which either can control where patients get treated.

back to top

Massachusetts Requests CMS Employer Mandate Flexibility

By Kevin Casey McAvey, Senior Manager, Manatt Health | Patricia M. Boozang, Senior Managing Director, Manatt Health

On March 14, 2017, Centers for Medicare and Medicaid Services (CMS) Administrator Seema Verma issued a joint letter with U.S. Department of Health and Human Services (HHS) Secretary Tom Price to the nation's governors, affirming the new Administration's commitment to empowering states "to advance the next wave of innovative solutions to Medicaid's challenges."i On March 22, Massachusetts HHS Secretary Marylou Sudders responded on behalf of the Baker Administration: "Massachusetts is eager to work with HHS…[and has] identified several critical areas that would benefit from swift federal intervention…[including granting Massachusetts the] flexibility to… replace the federal employer mandate with a state-specific approach to shared responsibility for employers."ii

From 2006 until 2013, Massachusetts administered its own employer mandate, the Employer Fair Share Contribution, which required employers with 11 or more full-time employees (FTEs) either to provide their employees with "fair and reasonable premium contributions" or to provide the state with an annual contribution of at least $295 per FTE.iii State collections were credited to the Commonwealth Care Trust Fund, and used to pay for health insurance subsidies for low-income residents (Commonwealth Care) and to support Medicaid providers.iv Fair Share was repealed in 2013 in anticipation of the Affordable Care Act's (ACA) employer mandate, a federal requirement which remains unimplemented.

Between Fair Share's repeal and the implementation of the ACA's expanded Medicaid eligibility provisions, the Baker Administration believes that the Commonwealth has felt "unintended consequences" of the ACA, with nearly half a million lives shifting from employer-sponsored insurance (ESI) into public coverage programs, increasing the state's healthcare costs, while leaving its uninsurance rate unchanged.v Massachusetts's Medicaid (MassHealth) spending on employed individuals increased by more than 250% between 2011 and 2015, excluding previous Commonwealth Care enrollees.vi Without reforms, including a Governor-proposed reinstituted employer mandate (a $2,000 employer contribution per full-time employee), the Baker Administration projects that MassHealth could face a $1.1 billion net funding gap by 2020.vii

Analysis Confirms Declines in Massachusetts's Employer Offer Rates and Employee Health Insurance Access

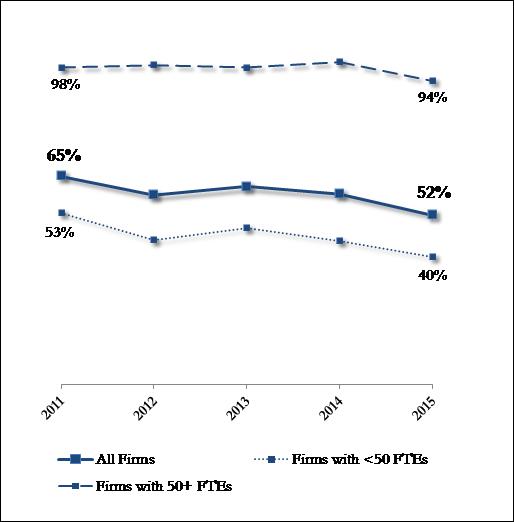

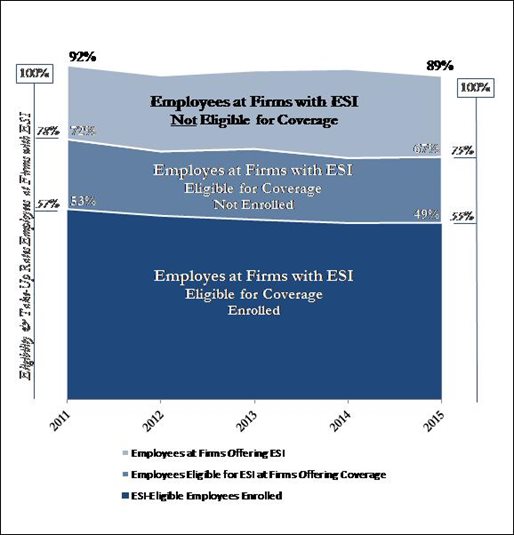

A Manatt Health analysis of Massachusetts's employer offer rate and employee take-up rate data supports the state's concerns.viii From 2011 to 2015, the percentage of Massachusetts employers offering health insurance fell by 13 percentage points to 52%, with most of the decline occurring since 2013 and from employers with fewer than 50 employees. (See Figure 1.ix) Combined with more modest declines in Massachusetts's employee eligibility and take-up rates, by 2015, fewer than half of Massachusetts's private-sector employees had access to, were eligible for and were enrolled in employer-sponsored health insurance. (See Figure 2.) The number of MassHealth enrollees with verified employment more than doubled during the period.x

Figure 1: Massachusetts's Employer Health Insurance Offer Rates (2011–2015)

Figure 2: Massachusetts's Employee ESI Eligibility and Take-Up Rates (2011–2015)

Source: Manatt Health analysis of AHRQ Medical Expenditure Panel Survey—Insurance Component data

In March, the Massachusetts Center for Health Information and Analysis released its Employer Survey confirming employer offer rate declines into 2016. The report notes a particularly significant drop in offer rates for the Commonwealth's smallest employers since 2011, many of which would have been previously subject to Massachusetts's Employer Fair Share Contribution.

The Massachusetts House Ways and Means Committee has since released a budget that directs the Department of Revenue to proceed with the development of a modified employer mandate, though one that allows for variation by employer and eligibility characteristics.xi The Governor has also continued to work with the business community to incorporate public comment on the size and form of a possible mandate.xii

ihttps://www.hhs.gov/about/news/2017/03/14/secretary-price-and-cms-administrator-verma-take-first-joint-action.html

iihttp://www.masslive.com/politics/index.ssf/2017/03/baker_administration_requests.html

iiiUsually in excess of 33%; repealed regulation available here: http://www.mass.gov/courts/docs/lawlib/900-999cmr/956cmr11.pdf

ivhttp://bluecrossmafoundation.org/content/section-8-part-1-commonwealth-care-trust-fund

vhttp://www.mass.gov/eohhs/docs/eohhs/insurance-market-reform-proposals.pdf

vihttp://www.mass.gov/eohhs/docs/eohhs/insurance-market-reform-proposals.pdf

viiSee above.

viiiMedical Expenditure Panel Survey—Insurance Component (2011–2015), available at https://meps.ahrq.gov/mepsweb/index.jsp

ixStatistically significant at the 95% level.

xPer "Massachusetts Insurance Market Reform, Affordability, and MassHealth Sustainability," MassHealth had 162,000 employed enrollees in 2011 and 379,000 employed enrollees in 2015, available at http://www.mass.gov/eohhs/docs/eohhs/insurance-market-reform-proposals.pdf

xihttp://www.masslive.com/politics/index.ssf/2017/04/massachusetts_house_would_give.html

xiihttp://www.eagletribune.com/news/baker-s-health-fees-face-scrutiny-in-house-budget/article_1952dad0-4bde-5c01-8e9e-361864b42bc1.html

back to top