Using Telehealth as a Tool for Health System Integration

By Jacqueline D. Marks, Manager, Manatt Health | Jared Augenstein, Senior Manager, Manatt Health | Thomas Enders, Senior Managing Director, Manatt Health

As discussed in our August Health Update article on patient engagement and digital health—the first in our new digital health series—the advent of digital and telehealth technologies is rapidly changing the way patients interface with health systems. The demand for telehealth services is growing dramatically, and systems that adopt telehealth solutions can achieve enhanced coordination and integration across clinical service lines. Patients are increasingly using digital tools to manage their care and relying on telehealth tools, such as video visits and remote patient monitoring, to conveniently access and monitor their care.

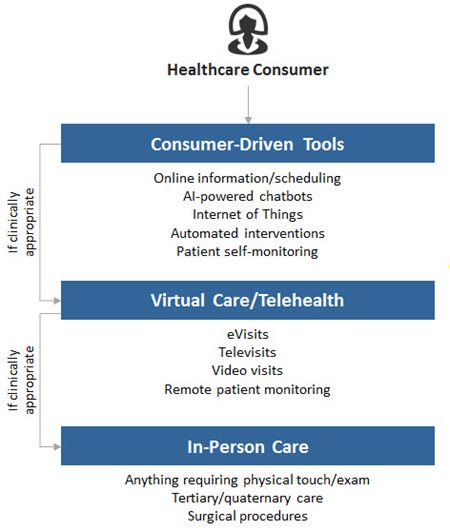

How Consumers Will Access Care in the Future

The adoption of telehealth technologies is critical to modern-day health system transformation efforts. To that end, health systems should carefully assess and strategically prioritize telehealth platforms that address system-specific objectives. There are a number of ways that telehealth supports system transformation, including:

- Enabling clinically integrated networks. Telehealth solutions can enable a higher degree of integration among service lines within a health system. For instance, eConsults' platforms bridge communication lines between primary care providers and specialists, allowing for rapid information sharing, the development of unified care plans and more coordinated care.

- Strengthening network development with care continuum partners. Telehealth solutions, such as virtual consults, can help link health systems with other care partners, such as long-term care facilities or behavioral health providers. For example, UPMC has implemented Project Raven, a virtual consult project that digitally connects UPMC hospitals with 15 partner nursing homes. Using videoconferencing technology, nursing homes can consult virtually with hospital staff to determine if a resident requires hospitalization. Over a three-year period, the project has yielded about $5 million in net savings, reduced potentially avoidable hospitalizations by 24% and decreased potentially avoidable emergency department visits by 41%.1

- Creating specialist capacity space efficiencies. Telehealth solutions can help ensure that patients are getting the “right care at the right time in the right place.” For example, instead of having a community primary care physician (PCP) referring a patient who may require a heart consult to a cardiologist, the PCP can request a case review from a cardiologist who can review the specific case on his or her computer and determine if that patient in fact requires specialty care. If the patient is not in need of care, the cardiologist can provide the PCP with recommendations and avoid an unnecessary office visit, which frees up both clinic space and the cardiologist’s time for more acute patients.

- Supporting consumerism strategies. Consumers are increasingly demanding and expecting on-demand services and solutions in the palms of their hands. Systems can stay ahead of consumer demands by offering mobile-based telehealth tools, such as on-demand urgent care video visits or second opinions.

The Challenges of Telehealth Adoption

Telehealth adoption is not without its challenges. Most health systems have struggled to define and deliver on large-scale telehealth program deployments. Common challenges that health systems experience include:

- Proliferation of departmental solutions or pilot projects without overarching vision and strategy

- Poor clinician adoption due to lack of integration with usual clinical workflows

- Inefficient financial incentives to scale programs

- Lack of alignment between system leaders, IT and clinical priorities

- Insufficiencies in existing technology to deliver new types of services

Successful telehealth implementation is dependent upon careful and methodical telehealth strategy development. We encourage health system leaders—including administration, clinical, operations and finance staff—to coalesce and consider what business and clinical problems they are trying to solve through telehealth; which clinical services and visit types lend themselves to telehealth models; how different telehealth models create value; how a telehealth program should be deployed, governed and organized; and what core telehealth technology platforms should be rolled out.

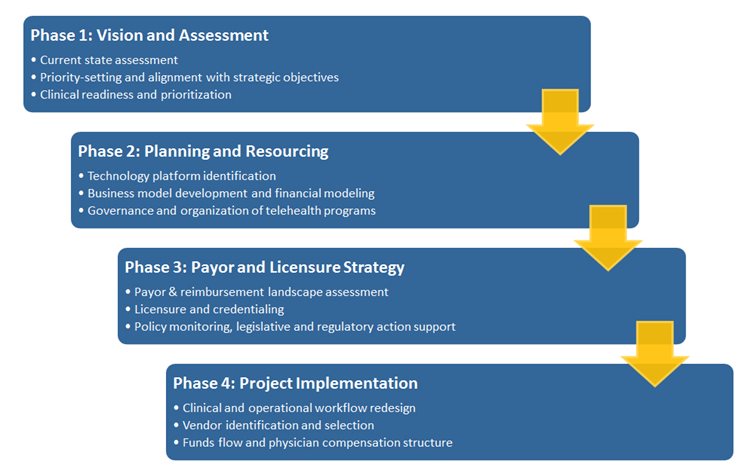

Finally, we believe that a systematic approach to telehealth strategy development is essential to successful telehealth adoption and implementation. The following telehealth strategy framework may be useful to health system leaders as they develop their own telehealth strategies:

Telehealth Strategy and Implementation Approach

1Steven Handler, Julia Dreissen, Tracy Polak, “UPMC: Achieving the Quadruple Aim: Using Telemedicine in Nursing Homes to Reduce Potentially Avoidable Hospitalizations,” presented at the 2017 ATA Conference.

back to top

Medicare Advantage Value-Based Insurance Design: The First Year

By Adam M. Finkelstein, Counsel, Manatt Health | Annemarie V. Wouters, Senior Advisor, Manatt Health | Devin A. Stone, Manager, Manatt Health

The Center for Medicare & Medicaid Innovation (CMMI) is now several months into the first year of implementation of the Medicare Advantage Value-Based Insurance Design (MA-VBID) model test, a pilot project measuring the potential for value-based insurance design (VBID) in the Medicare Advantage program.1, 2 In the model test, participating Medicare Advantage Organizations (MAOs), which ordinarily offer Medicare Advantage and Part D benefits to each of their enrollees in a plan uniformly at the same level of coverage and cost sharing, can offer extra coverage or reduced cost sharing specifically to enrollees with CMMI-specified chronic conditions, rather than to the plan’s membership at large.

Still, little is known about what disease conditions and value-based design approaches the MAOs participating in the model test have focused on in the first year of implementation. The Centers for Medicare & Medicaid Services (CMS) prohibits the MAOs from marketing their VBID benefits and has not released an authoritative compendium of the model test’s approaches.3 In addition, while CMS has generally identified the MAOs participating in the program, it has not specified the number of enrollees to which those MAOs may be offering extra coverage or reduced cost sharing.

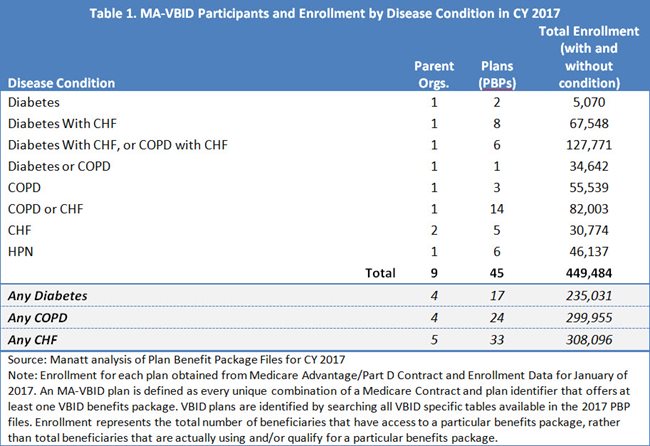

The CMS Medicare Advantage Plan Benefit Package files, which contain data on each participating MAO’s VBID benefits, hold the answers to these questions. Manatt Health analyzed these files to determine which MAOs participated in the VBID model test and what value-based approaches are being used in their individual plans (also known as plan benefit packages (PBPs)) for which disease conditions. Our findings for CY 2017 show that MAO approaches to VBID focus on diabetes, congestive heart failure, chronic obstructive pulmonary disease and hypertension.

About 2% of All Medicare Advantage Enrollees Potentially Have Access to VBID Benefits in 2017.

In the first year of implementation, there are 11 MAOs participating in the model test by offering extra benefits or reduced cost sharing to their enrollees. Because two of them are under common ownership, these 11 represent nine unique corporate parent organizations. They are Aetna Inc., Fallon Community Health Plan, Geisinger Health System, Indiana University Health, Tufts Associated HMO, Inc., UPMC Health System, Highmark Health, Blue Cross and Blue Shield of Massachusetts, Inc. and Independence Health Group, Inc.4

The MAOs are concentrated geographically with five participating in Pennsylvania, three in Massachusetts and one in Indiana. There are no MAOs participating in Arizona, Iowa, Oregon or Tennessee, states from which CMS would have admitted MAOs to the test.5 The participating MAOs have collectively entered 45 plans (or PBPs) into the model test, which enroll 2% of Medicare Advantage enrollees nationally.6 The number of enrollees who actually enjoy VBID benefits will be substantially fewer. Only those enrollees with specific chronic conditions, and in some cases who earn benefits through participation in wellness programs, will actually get VBID benefits.

MAOs Are Mostly Focusing Their VBID Benefit Strategies on Enrollees With Diabetes, Congestive Heart Failure and Chronic Obstructive Pulmonary Disease or Comorbidities of These Conditions.

All but one participating MAO in 2017 focused on diabetes, congestive heart failure (CHF) or chronic obstructive pulmonary disease (COPD), in some combination, by offering VBID benefits to enrollees with those conditions. MAOs have a total enrollment of 308,096 enrollees in plans (or PBPs) offering VBID benefits focused on CHF either as a single condition or with a comorbidity; 299,995 enrollees in plans focused on COPD either as a single condition or with a comorbidity; and 235,031 enrollees in plans focused on diabetes either as a single condition or with a comorbidity. A single MAO with total enrollment of 46,137 in plans is offering VBID benefits focused on hypertension (HPN). Notably in this first year, none addressed patients with past stroke, coronary artery disease or mood disorders, though CMMI would have permitted these strategies. (See Table 1.)

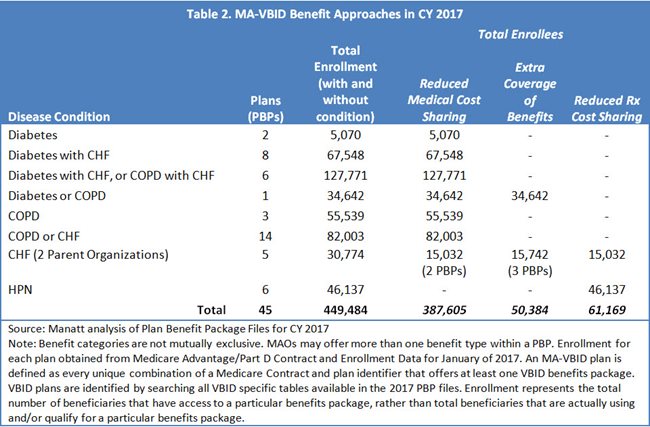

Participating MAOs Are Mostly Reducing Cost Sharing for Medical Benefits.

In 36 of the 45 plans (or PBPs) in the model test, enrollees with chronic conditions receive reduced cost sharing for medical benefits, occasionally in combination with extra coverage of services or reduced cost sharing for Part D drugs. There are three plans (or PBPs) where extra coverage is the only VBID benefit, and six where reduced drug cost sharing is used alone. (See Table 2.)

Most MAOs Offering VBID Benefits Require Enrollees to Meet Some Prerequisite Beyond Having a Chronic Condition to Earn Those Benefits.

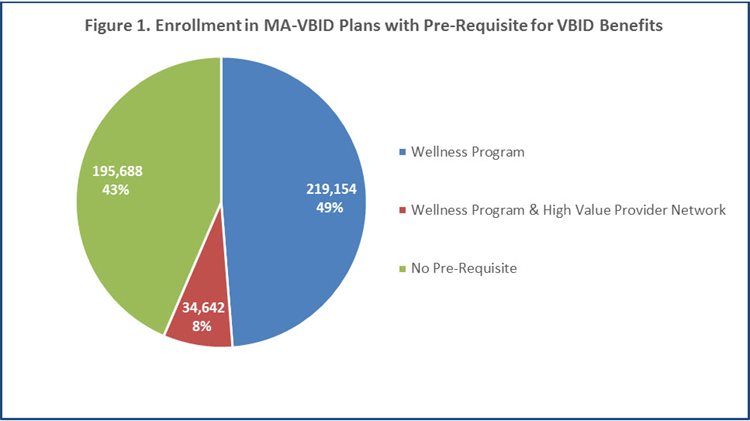

Approximately 57% of enrollees are in plans (or PBPs) where they must meet a prerequisite beyond merely having a chronic condition to earn VBID benefits. In every case, that prerequisite includes participation in some type of wellness program before earning benefits. The enrollees of one plan (or PBP) must also obtain their VBID benefits from a high-value provider network. (See Figure 1.)

Source: Manatt analysis of Plan Benefit Package Files for CY 2017

Note: Enrollment for each plan obtained from Medicare Advantage/Part D Contract and Enrollment Data for January of 2017. An MA-VBID plan is defined as every unique combination of a Medicare Contract and plan identifier that offers at least one VBID benefits package. VBID plans are identified by searching all VBID specific tables available in the 2017 PBP files. Enrollment represents the total number of beneficiaries that have access to a particular benefits package, rather than total beneficiaries that are actually using and/or qualify for a particular benefits package.

Overall, the MAOs participating in the first year of the MA-VBID model test are clustered geographically, and are largely focusing on the same disease conditions: diabetes, CHF and COPD, in some form. They have also largely chosen the same VBID benefit types: reduced medical cost sharing contingent on participation in a wellness program (though the specific VBID benefits offered may vary greatly from plan to plan). These MAOs are permitted to change their strategies in the second year. But many are expected to stay the course for at least two years, as CMMI has required that Year 2 (CY 2018) applications be submitted early in the first year of the test, before true implementation experience could accrue. Manatt Health expects CMMI to release data on Year 2 benefits in fall 2017, including information on new participants, if any. We will continue to monitor and analyze trends moving forward.

For more information about this or other Medicare analyses, please contact Adam Finkelstein at afinkelstein@manatt.com or Annemarie Wouters at awouters@manatt.com.

1CMS, “Announcement of Medicare Advantage Value-Based Insurance Design Model Test” (Sept. 1, 2015) https://innovation.cms.gov/Files/reports/VBID-Announcement-REVISED-10-9-15.pdf

242 U.S.C. § 1315A(a). CMMI was established under the Affordable Care Act for the purpose of testing innovative payment and service delivery models in Medicare, Medicaid and the Children’s Health Insurance Program (CHIP)

3CMS, “Medicare Advantage Value-Based Insurance Design Model; Request for Applications,” (Oct. 9, 2015) https://innovation.cms.gov/Files/reports/VBID-RFA-10-9-15.pdf

4https://data.cms.gov/Special-Programs-Initiatives-Speed-Adoption-of-Bes/Medicare-Advantage-Value-Based-Insurance-Design-Mo/7rb6-e5sn

5Manatt analysis of Plan Benefit Package files and Medicare Advantage/Part D Contract and Enrollment Data for CY 2017

6Manatt analysis of Plan Benefit Package files for CY 2017. Note: Enrollment for each plan was obtained from Medicare Advantage/Part D Contract and Enrollment Data for January of 2017. For our analysis, an MA-VBID plan is defined as every unique combination of a Medicare Contract and plan identifier that offers at least one VBID benefits package. These VBID plans are identified by searching all VBID specific tables available in the 2017 PBP files.

back to top

Raising the Bar in Attribution

By Carol Raphael, Senior Advisor, Manatt Health | Ateev Mehrotra, M.D., Department of Healthcare Policy, Harvard Medical School | Helen Burstin, M.D., National Quality Forum

Editor’s Note: In a recent issue of Annals of Internal Medicine, the premier internal medicine journal published by the American College of Physicians, Manatt Health coauthored a new article calling for raising the rigor and transparency around how attribution models are chosen. The article, summarized below, examines concerns with current models, as well as details approaches for moving forward.

______________________________________________

To improve coordination and integration of care, the U.S. Department of Health & Human Services has set an ambitious goal of tying more than 90% of Medicare payments to quality by 2018 and shifting more than half of payments to alternative payment models, such as accountable care organizations (ACOs) and bundled payments. Unfortunately, in this rapid shift to new payment models, the issue of attribution is not receiving sufficient attention.

What Are Attribution Models?

Patients receive care from a broad range of providers, including hospitals, physicians and nurses. Attribution models are sets of rules used to determine which providers (or groups of providers) have responsibility for a patient’s care, from a quality, cost or payment perspective. The models vary widely and are often complex.

Concerns With Current Models

There are several major concerns with current attribution models:

- Methods for determining attribution vary widely and are inconsistent.

- There is a lack of transparency around how a patient’s care is attributed and often an inability to clarify or appeal the model.

- Providers worry that they will be held responsible for care over which they have little control. For example, an attribution model may assign responsibility for a woman’s breast cancer screening to the physician who saw the patient for the most visits in a year—but that physician might be a dermatologist who expects the patient’s primary care physician to be responsible for breast cancer screening.

The limited literature on the topic has shown that attribution models matter, often significantly. In one study, more than half of physicians were assigned to a different cost category (high, average or low) if an attribution model other than the default was used.

How to Move Forward

The National Quality Forum tackled the concerns around current attribution models in a multistakeholder committee. Though it is not currently feasible to select a single, ideal attribution model for use across all applications, there are several ways that the clinical and policy communities can move forward:

- More attention must be paid to attribution, given its proven importance.

- Health plans and other payers can use the National Quality Forum’s selection guide, “Attribution: Principles and Approaches,” to help them determine the right attribution model.

- New ways of attributing care must be considered, such as using data from electronic health records.

- Greater transparency and mechanisms for appealing inappropriate attribution are needed.

- Attributed providers (whether individual physicians or organizations) must be able to influence the outcomes for which they are held accountable.

Summary

The issue of attribution clearly will become more and more important, as the United States moves forward with alternative payment models and increased performance measurement. We need to raise the bar on the rigor and transparency around how attribution models are chosen.

back to top

New Manatt Webinar, “Tapping Into Global and National Patient Markets”

Join Us on October 25 From 1:00 to 2:00 p.m. ET, and Learn to Attract and Support Patients Beyond Your Local Market. Click to Register Free.

International patients seeking advanced medical treatment spent more than $3.5 billion in the United States in 2015, increasing more than 25% since 2010.1 Each year, 300,000 international patients visit this country for quality medical care.2 Domestic medical travel is also on the rise. It’s estimated that 15% of the nation’s top-50 employers now offer domestic medical travel programs.3

How can you reach, attract and support patients from across the country—and around the world? How can you provide high-quality care and support to patients outside your local region? Find out at Manatt’s new webinar, “Tapping into Global and National Patient Markets: Strategies for Becoming a Destination Provider.” Click to register free, and discover:

- Perspectives on relative market size and potential

- Successful strategies that destination medical centers use to attract and support national and international patients

- The challenges of providing care and follow-up to patients beyond your geographical boundaries—and how to overcome them

- The potential for using telehealth and customer relationship management (CRM) tools to engage patients, facilitate services and improve care quality

- Best practices you can learn from other industries that are effectively attracting and serving national and global markets

Even if you can’t make the original airing on October 25, click to register free now, and you will receive a link to view the program on demand.

Presenters:

Michael Merritt, Jr., Managing Director, Manatt Health

Jared Augenstein, Senior Manager, Manatt Health

1 U.S. Cooperative of International Patient Programs

2 Patients Beyond Borders

3 “Medical Travel: Access to Savings and Quality Healthcare,” The Balance, Laura Carabello, September 2015.

back to top

Boycott Claims Dismissed for Applying Per Se Standard

By Lisl J. Dunlop, Partner, Antitrust and Competition | Shoshana S. Speiser, Associate, Litigation

Editor’s Note: In a recent “Antitrust Practice Group Bulletin” for the American Health Lawyers Association, Manatt Health examined the August 9, 2017, decision by a federal district court to dismiss Sherman Act group boycott claims that The Medical Center at Elizabeth Place, LLC (MCEP) brought against Premier Health Partners (Premier) and its participating hospitals, because MCEP erroneously sought to apply the per se standard to the defendants’ activities. The decision provides guidance for considering restraints in the context of legitimate joint ventures and highlights the practical differences between pleading rule of reason and per se cases. Key points are summarized below.

__________________________________________

Background

In 2012, MCEP, a 26-bed adult acute care hospital, sued Premier, a not-for-profit corporation formed by a Joint Operating Agreement among Atrium Health System, Catholic Health Initiatives, MedAmerica Health Systems Corporation, Samaritan Health Partners and UVMC. MCEP alleged that the defendants organized a group boycott of MCEP, denying MCEP access to essential managed care contracts, physicians and funding.

In 2014, Judge Black granted summary judgment for the defendants on the basis that they formed a single entity and therefore could not be “conspiring” under Section 1 of the Sherman Act. MCEP appealed, and in 2016 the U.S. Court of Appeals, Sixth Circuit reversed and remanded. Using the Supreme Court’s decision in American Needle, Inc. v. National Football League, 560 U.S. 183 (2010) as a guide, the Sixth Circuit ruled that a reasonable jury could conclude that the defendant hospitals, in fact, operated as independent entities, behaving more like competitors than one, united organization. (We reported on the case in the April 2016 issue of Manatt “Health Update.”)

On remand, Judge Black overruled a summary judgment motion brought by the defendants, arguing that, because the per se rule does not apply, MCEP’s claims should be dismissed. When Judge Black recused himself, the defendants filed a motion for reconsideration as to the applicable legal standard with Judge Rice. Judge Rice granted the defendants’ motion for summary judgment. The judge found that MCEP’s claim was not subject to per se condemnation and dismissed the complaint, because MCEP disavowed any reliance on the rule of reason.

When Are a Joint Venture’s Restraints Per Se Illegal?

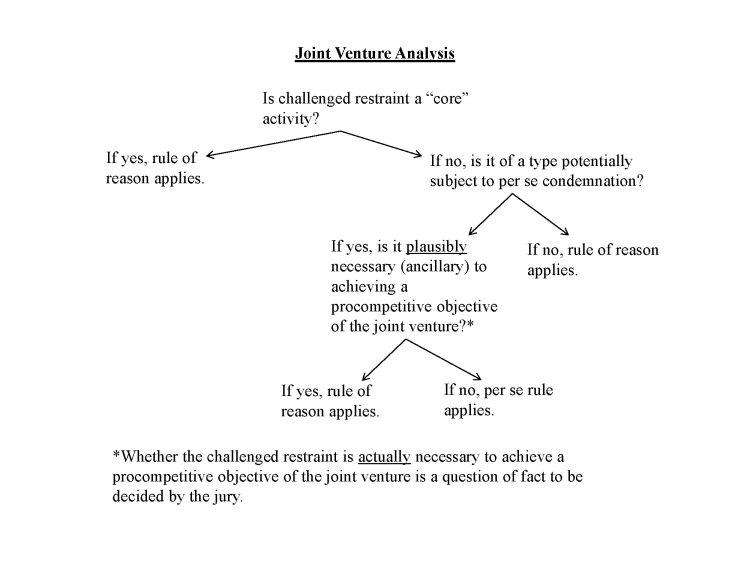

Judge Rice explained that very few restraints are condemned per se. The vast majority are examined on a case-by-case basis under the “rule of reason” standard. A category is deemed per se illegal when the entire category of restraints has such a clear lack of redeeming virtue that it is conclusively presumed to be unreasonable. Therefore, the plaintiff does not need not prove an effect on the market.

Citing the Supreme Court’s decision in Texaco Inc. v. Dagher, 547 U.S. 1 (2006), Judge Rice stated that both a joint venture’s core and ancillary activities are subject to the rule of reason. Joint ventures are not insulated from per se violations. They are, however, more likely to be judged under the rule of reason, because they may increase efficiency. Therefore, otherwise per se illegal activities may be permitted when they are necessary to achieve the joint venture’s efficiency-enhancing purpose.

The decision lays out the framework for considering whether a restraint is subject to the rule of reason or per se rule in the following decision tree:

Using this framework, the court examined the two restraints that MCEP challenged:

1. Volume-Based Pricing/Panel Limitation Provisions

Under the defendants’ panel limitations provision, if an insurer adds other hospitals to its network and dilutes the volume the defendants expect from that insurer, the defendants can terminate the contract or renegotiate rates. The court found that these provisions were not subject to per se condemnation for four reasons:

a) The provisions are a vertical—not horizontal—restraint. (A horizontal restraint must stem from a horizontal agreement, not just have horizontal effects.)

b) Even if the panel limitations provision was a horizontal restraint, because pricing is a core activity of the joint venture’s operations, it would still not be subject to per se treatment.

c) The restraint was not a blatant restraint of trade typically subject to per se analysis, because the contracts did not explicitly prohibit insurers from adding other hospitals. Courts have consistently rejected antitrust challenges to short-term exclusive contracts between insurers and hospitals.

d) The panel limitation was plausibly necessary to the joint venture’s purpose because it helped ensure that patient volume at the hospital remained steady as a quid pro quo for the discounted rates offered, which could reduce premiums and increase options for consumers. As a result, the restriction was plausibly necessary to the joint venture’s purpose and therefore subject to the rule of reason.

2. Non-Compete Provisions

MCEP also challenged the defendants for enforcing certain non-compete provisions in leases and physician employment contracts when physicians invested in MCEP, affiliated with MCEP or referred patients to MCEP. Again, Judge Rice found these provisions to be purely vertical and therefore not subject to per se condemnation. After examining the non-compete clauses under Dagher, the judge concluded that the provisions were legal under the rule of reason. The non-compete provisions were core to the joint venture’s activities, and it is plausible that the restraints were necessary to achieve the procompetitive benefits of the joint venture.

Aren’t Group Boycotts Always Per Se Illegal?

The court rejected MCEP’s contention that group boycotts are always per se unreasonable restraints on trade, making it improper to consider whether the challenged restraints are plausibly necessary to achieve some of the joint venture’s procompetitive objectives. Although the court noted that “it is true that group boycotts have often been included on the list of ‘classes of economic activity that merit per se invalidation under § 1,’” the court concluded that not all concerted refusals to deal (i.e., group boycotts) are predominantly anticompetitive.

Citing Northwest Wholesale Stationers, Inc. v. Pacific Stationery & Printing Co., 472 U.S. 284 (1985), the court identified three characteristics of per se illegal group boycotts:

- They involve joint efforts to disadvantage competitors by cutting off access to necessary supplies and customers;

- The defendants possess a dominant position in the relevant market; and

- The practices are generally not justified by plausible arguments that they were intended to enhance overall efficiency and increase market competition.

A concerted refusal to deal does not need to possess all these traits to merit per se treatment. In this case, however, the court found that, even assuming arguendo that the alleged group boycott involved efforts to disadvantage MCEP by cutting off access to necessary managed care contracts, physicians and/or investors, and assuming Premier possessed a dominant position in the relevant market, the challenged restraints were nevertheless plausibly intended to increase both overall efficiency and market competition. Therefore, they were not subject to per se condemnation.

back to top