In this issue, Manatt examines how benchmarking programs can elevate the importance of primary care and behavioral health care investments and allow for the measurement of spending on these critical preventive services. A PDF of our update is also available here.

Leveraging State Benchmarking Programs to Drive Investments in Primary Care

The takeaway. State cost growth benchmarking programs support market transparency and accountability, and may be used to assess and redirect health care spending to higher-value, preventive services, such as primary and behavioral health care, through priority service targets.

What it is. States are increasingly seeking to both constrain health care cost growth as well as influence where health care dollars are being invested, with the goal of redirecting spending to high-value services and activities that support long-term population health, such as primary care.

While the U.S. far exceeds peer countries in health care spending—at $4.1 trillion or $12,530 per person in 20201—it continues to lag in terms of care access, administrative efficiency, equity and health care outcomes: There is a disconnect between how much the U.S. is investing in health and how much it is getting in return.2 Studies indicate that the disconnect may be attributable, in part, to where health care dollars are being invested. Studies of other Organization for Economic Cooperation and Development (OECD) countries indicate that stronger primary care systems, for example, are correlated with better population health outcomes, such as lower overall mortality rates, lower rates of premature death and lower hospitalizations for ambulatory care sensitive conditions,3 and higher infant birth weight, life expectancy and overall satisfaction with the health care system.4 Even within the U.S., communities with greater primary care availability have reported better patient outcomes as well as decreased utilization of more costly health service categories, such as inpatient hospitalizations and emergency department visits.5

States like Rhode Island and Delaware have long recognized the value of investments in primary care and successfully directed attention and spending through existing insurance regulatory authorities. Other states, such as Connecticut and Massachusetts, are testing how they may leverage their benchmarking programs as a mechanism for advancing broader primary care investment agendas.

In 2010,

Rhode Island implemented Affordability Standards,

6 which established annual price inflation caps and required regulated commercial insurers to spend at least 10.7% of their total health care spending on primary care services under the health insurance commissioner’s rate review authority.

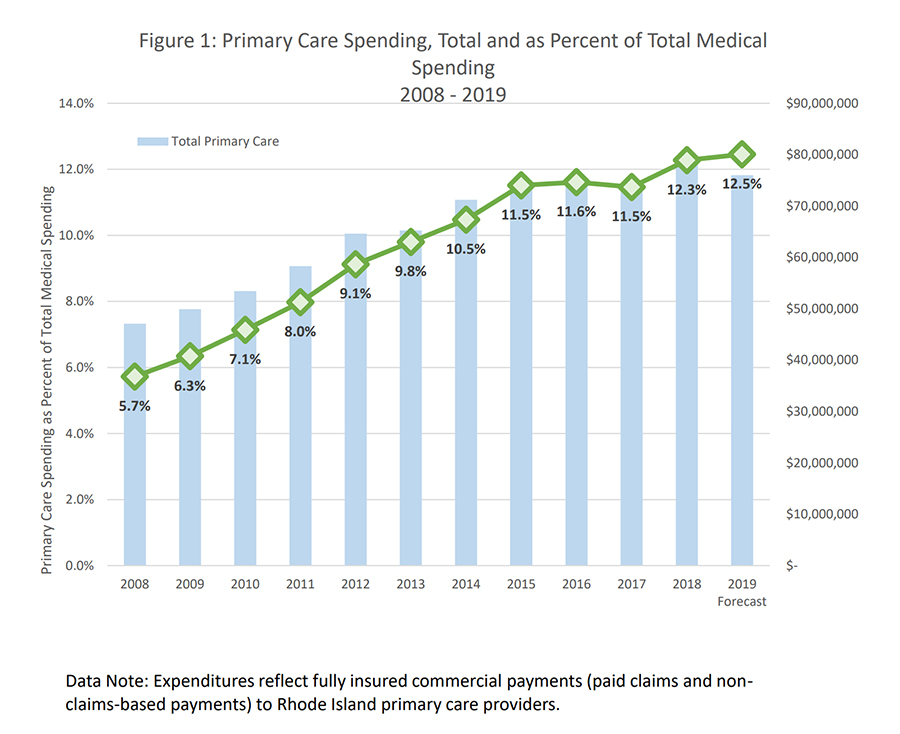

7 Insurer primary care spending subsequently increased from 5.7% in 2008 to 9.1% in 2012 and achieved the state-set target of 10.7% in 2014

8 before reaching 12.3% of total medical spending in 2018 (see Figure 1).

9 A 2019 study found that the Affordability Standards increased aggregate primary care spending and saw reductions in total spending growth, with no impacts on health care quality.

10

Figure 1. Primary Care Spending in Rhode Island, Total and as a Percentage of Total Medical Spending, 2008–2019

In 2020, Delaware’s Department of Insurance Office of Value Based Health Care Delivery (OVBHCD)11 proposed similar affordability standards, which the state is seeking to codify through its proposed Regulation 1322 Requirements for Mandatory Minimum Payment Innovations in Health Insurance.12, 13 The standards would, among other actions, set a target for commercial health insurers to increase investments in primary care14 by 1.5% annually, targeting an increase in primary care spending from 7% of total cost of care in rate filing year 2022 (plan year 2023) to 11.5% by rate filing year 2025 (plan year 2026).15, 16, 17

States may also advance primary care investment agendas through their existing benchmarking programs and processes.

The Challenge of Defining “Primary Care Services” to Support Spending Measurement

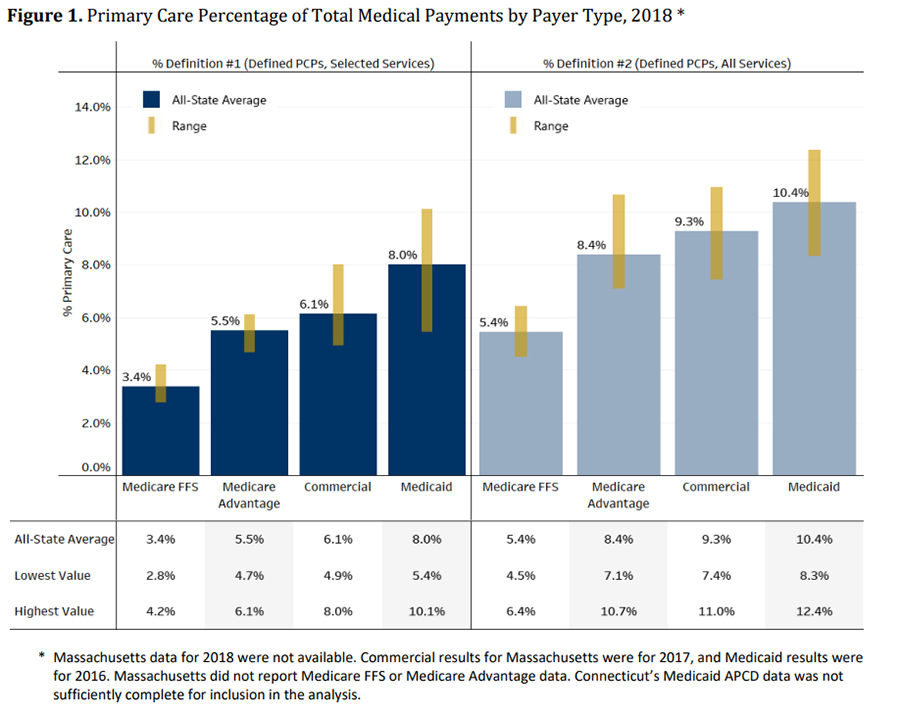

In 2018, the New England States Consortium Systems Organization (NESCSO) developed a standardized methodology for calculating all-payer primary care spending across six New England states—Connecticut, Maine, Massachusetts, New Hampshire, Rhode Island and Vermont—using each state’s respective all-payer claims database (APCD) data.18 NESCSO developed and tested the following definitions for primary care in its analysis:

- “Defined PCPs, Selected Services,” which includes selected claims payments for general practice, family medicine, pediatrics, internal medicine, nurse practitioner and physician assistant and excludes OB/GYN services.

- “Defined PCPs, All Services,” which includes all claims payments for the provider services listed in Definition 1 and continues to exclude OB/GYN services. This definition did not restrict service codes.

NESCSO found that the all-state average of primary care spending as a proportion of total medical spending ranged from

5.5% to

8.2%, depending on the definition used to capture primary care providers, services and spending. Primary care spending as a proportion of total spending was highest for the Medicaid population (8.0%–10.4% by state), followed by commercial (6.1%–9.3%), Medicare Advantage (5.5%–8.4%) and Medicare fee-for-service (3.4%–5.4%). See Figure 2 below for more detail. These findings align with other recent state studies that have examined total primary care spending.

19

Figure 2. Primary Care Percentage of Total Medical Payments by Payer Type, 2018, NESCSO Study

What it means. Health care cost growth benchmarking programs can provide states with a mechanism to similarly advance cost containment and “priority service” objectives, allowing stakeholders to measure and monitor primary care spending against total system spend and use this information to influence investments in preventive services.

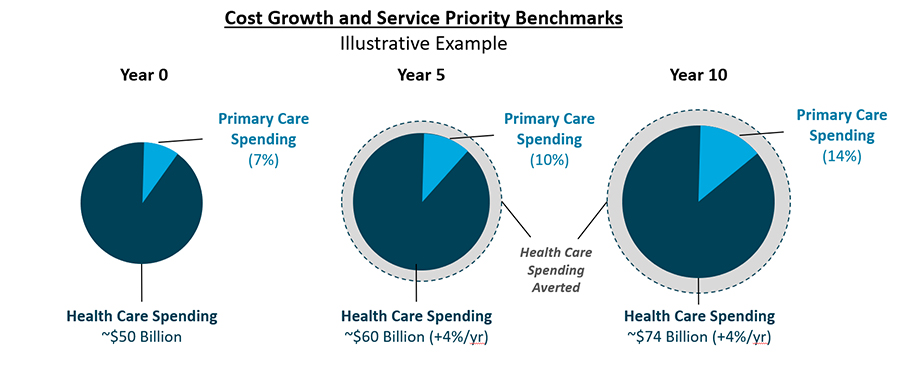

State cost growth benchmarking programs are data-driven, transparency-focused cost-containment initiatives that measure resident health care spending growth in relation to established targets; payers and providers that exceed targets may be subject to public inquiry or penalty. States collect benchmarking data directly from public and private payers operating in their states, monitoring health care spending across all lines of business. Payers may be asked to segment spending data by service category (which may be expanded to include primary care services and other priority services), key populations or product types, attribute spending to providers who may influence patient service utilization, or supplement “core” reporting with contextual information.20 States are then able to analyze payer data to understand broad market health care spending trends, and to better target policy and program actions to address cost drivers—or, for “priority service” areas like primary care, advance agendas that displace lower-value spending with spending on services that promote long-term population health outcomes (see Figure 3 below).

Figure 3. Illustrative Example of Increased Investments in Primary Care and Impacts on Overall Health Care Cost Growth Over Time

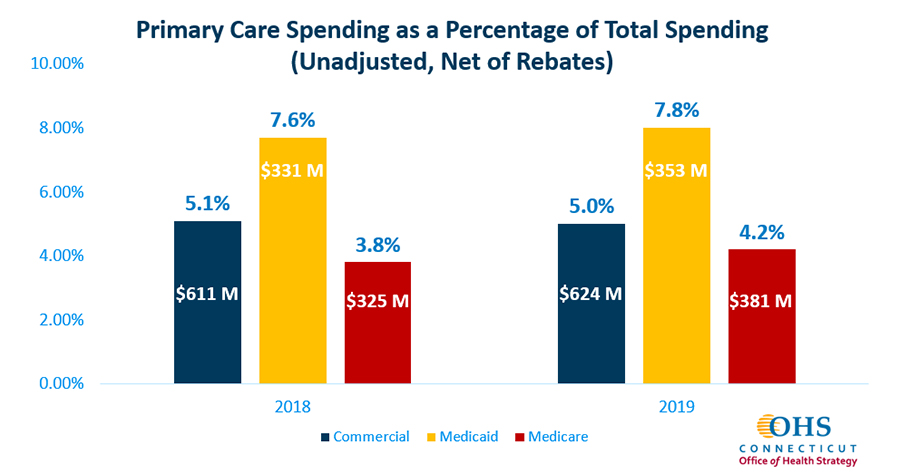

Connecticut. In 2020, Connecticut’s Governor Lamont issued Executive Order No. 5, which, in addition to establishing the statewide cost growth benchmark, also charged the Office of Health Strategy (OHS) with developing and recommending a primary care spending target for the state beginning in 2021 in order to reach a primary care spending target of 10% (as a percentage of total health care expenditures, or THCE) by 2025. OHS’ preliminary analysis of primary care spending in the state by market found that the state’s average primary care spending in 2019 was 5.3%, with the highest percentage of primary care spend within Medicaid (7.8%), followed by the commercial market (5.0%) and Medicare (4.2%) (see Figure 4). In December 2021, OHS adopted primary care spending targets of 5.3% for 2022, 6.9% for 2023, 8.5% for 2024 and 10% by 2025. OHS will collect primary care spending data from payers within their cost growth benchmark data submissions in late 2022.

Figure 4. Primary Care Spending as a Percentage of Total Spending in Connecticut, 2018 and 2019 21

Massachusetts. In March 2022, Massachusetts’ Governor Baker similarly filed “An Act Investing in the Future of Our Health” for the creation of a statewide aggregate primary care and behavioral health care spending target and set a goal of increasing spending on these services by 30% over three years while maintaining the state’s health care cost growth benchmark.22, 23 Payer and provider progress toward meeting spending targets will be assessed by the state’s Center for Health Information (CHIA) and Health Policy Commission (HPC) through its regular cost growth benchmark reporting process. Entities that fail to achieve the established primary care spending target may be required to complete a performance improvement plan (PIP) wherein they identify strategies to increase investments in primary care and behavioral health. The Baker-Polito Administration estimates this action will generate nearly $1.4 billion in systemwide investments for primary care and behavioral health services over the next three years.24

Massachusetts. In March 2022, Massachusetts’ Governor Baker similarly filed “An Act Investing in the Future of Our Health” for the creation of a statewide aggregate primary care and behavioral health care spending target and set a goal of increasing spending on these services by 30% over three years while maintaining the state’s health care cost growth benchmark.22, 23 Payer and provider progress toward meeting spending targets will be assessed by the state’s Center for Health Information (CHIA) and Health Policy Commission (HPC) through its regular cost growth benchmark reporting process. Entities that fail to achieve the established primary care spending target may be required to complete a performance improvement plan (PIP) wherein they identify strategies to increase investments in primary care and behavioral health. The Baker-Polito Administration estimates this action will generate nearly $1.4 billion in systemwide investments for primary care and behavioral health services over the next three years.24

Other states pursuing benchmarking programs are also considering setting primary care and behavioral health priority service targets as part of their programs.25 California’s AB-1130, proposes establishing an Office of Health Care Affordability, a statewide cost growth benchmark, and priority service benchmarks for primary care and behavioral health investments.26

What happens next. As state cost growth benchmarking programs continue to proliferate and mature, more states will explore ways to leverage their data collection and reporting to advance local priorities, including increasing investments in preventive services like primary care and behavioral health.

To return to the Manatt State Cost Containment Update Home Page, please click here.

1 “NHE Fact Sheet,” Centers for Medicare & Medicaid Services. Available here: https://www.cms.gov/Research-Statistics-Data-and-Systems/Statistics-Trends-and-Reports/NationalHealthExpendData/NHE-Fact-Sheet

2 “Mirror, Mirror 2021: Reflecting Poorly—Health Care in the U.S. Compared to Other High-Income Countries,” The Commonwealth Fund. August 4, 2021. Available here: https://www.commonwealthfund.org/publications/fund-reports/2021/aug/mirror-mirror-2021-reflecting-poorly

3 M. Niti, T. Ng. “Avoidable hospitalisation rates in Singapore, 1991–1998: assessing trends and inequities of quality in primary care,” Journal of Epidemiology and Community Health. January 2003. Available here: https://www.ncbi.nlm.nih.gov/pmc/articles/PMC1732279/

4 J. Macinko, B. Starfield, L. Shi. “The Contribution of Primary Care Systems to Health Outcomes within Organization for Economic Cooperation and Development (OECD) Countries, 1970–1998,” Health Services Research. June 2003. Available here: https://www.ncbi.nlm.nih.gov/pmc/articles/PMC1360919/

5 C. Chang., T. A. Stukel, A. B. Flood, D. C. Goodman. “Primary Care Physician Workforce and Medicare Beneficiaries’ Health Outcomes,” JAMA. May 25, 2012. Available here: https://www.ncbi.nlm.nih.gov/pmc/articles/PMC3108147/

6 230-RICR-20-30-4.10 – Affordable Health Insurance – Affordability Standards. Current, effective June 2020. Available here: https://ohic.ri.gov/sites/g/files/xkgbur736/files/2022-03/230-ricr-20-30-4-final-sos.pdf

7 Equal to the Medicare price index plus one percentage point for both inpatient and outpatient services.

8 “Investing in Primary Care: A STATE-LEVEL ANALYSIS,” Patient-Centered Primary Care Collaborative, Robert Graham Center and Milbank Memorial Fund. July 2019. Available here: https://www.graham-center.org/content/dam/rgc/documents/publications-reports/reports/Investing-Primary-Care-State-Level-PCMH-Report.pdf

9 http://www.ohic.ri.gov/documents/2020/June/Primary%20Care%20Expenditure%20Data%20Update%20June%202020.pdf

10 A. Baum et al. “Health Care Spending Slowed After Rhode Island Applied Affordability Standards To Commercial Insurers,” Health Affairs. February 2019. Available here: https://www.healthaffairs.org/doi/10.1377/hlthaff.2018.05164

11 Established via Senate Bill 116, 150th General Assembly (2019–2020). Available here: https://legis.delaware.gov/BillDetail/47520

12 Office of Value Based Health Care Delivery (OVBHCD), Delaware Department of Insurance. Available here: https://insurance.delaware.gov/divisions/consumerhp/ovbhcd/

13 “1322 Requirements for Mandatory Minimum Payment Innovations in Health Insurance, Proposed Rule, Public Notice.” Department of Insurance, Office of the Commissioner. Available here: https://regulations.delaware.gov/register/january2022/proposed/25%20DE%20Reg%20684%2001-01-22.htm

14 Beginning in rate filing year 2022 (for plan year 2023).

15 “An Integrated Approach to Improve Access, Quality and Value,” OVBHCD, Delaware Department of Insurance. December 18, 2020. Available here: https://insurance.delaware.gov/wp-content/uploads/sites/15/2020/12/Delaware-Health-Care-Affordability-Standards-Report-12182020.pdf

16 “Delaware Sets Primary Care Investment Target,” Primary Care Collaborative. January 28, 2021. Available here: https://www.pcpcc.org/fr/node/209659

17 Delaware’s Affordability Standards also incorporated price caps for aggregate unit price growth for inpatient and outpatient hospital services through 2025 to contain health care cost growth.

18 “The New England States’ All-Payer Report on Primary Care Payments,” New England States Consortium Systems Organization (NESCSO). December 22, 2020. Available here: https://nescso.org/wp-content/uploads/2021/02/NESCSO-New-England-States-All-Payer-Report-on-Primary-Care-Payments-2020-12-22.pdf

19 “Investing in Primary Care, A State-Level Analysis,” Patient-Centered Primary Care Collaborative (PCPCC). July 2019. Available here: https://www.pcpcc.org/sites/default/files/resources/pcmh_evidence_report_2019.pdf

20 J. Ario, K. McAvey, A. Zhan. “State Benchmarking Models: Promising Practices to Understand and Address Health Care Cost Growth,” Manatt Health. June 2021. Available here: https://www.manatt.com/insights/white-papers/2021/state-benchmarking-models-promising-practices-to-u

21 “Leveraging State Benchmarking Models to Address Health Care Cost Growth,” Manatt Health webinar, April 2022. Available here: https://www.manatt.com/insights/webinars/leveraging-state-benchmarking-models-to-address-he

22 S. 2774, “An Act Investing in the Future of Our Health.” Filed March 17, 2022. Available here: https://malegislature.gov/Bills/192/S2774

23Calendar year (CY) 2019 will serve as the baseline year CY 2024 spending will be measured against.

24 “Baker-Polito Administration Files Health Care Legislation Aimed at Expanding Access to Care,” Press Release, Office of Governor Baker and Lt. Governor Polito. March 15, 2022. Available here: https://www.mass.gov/news/baker-polito-administration-files-health-care-legislation-aimed-at-expanding-access-to-care

25 “Groundbreaking Study Links Higher Primary Care Spending to Better Care Quality in California,” California Health Care Foundation. April 19, 2022. Available here: https://www.chcf.org/press-release/groundbreaking-study-links-higher-primary-care-spending-to-better-care-quality-in-california/

26 AB-1130, California Health Care Quality and Affordability Act (2021–2022 Regular Session). Introduced February 18, 2021. Available here: https://leginfo.legislature.ca.gov/faces/billNavClient.xhtml?bill_id=202120220AB1130

To return to the Manatt State Cost Containment Update Home Page, please click here.