Marketplace Coverage Rollbacks Will Hit Non-Expansion States the Hardest

The “One Big Beautiful Bill Act” (H.R. 1), currently under consideration in the Senate, proposes sweeping changes to Affordable Care Act (ACA) Marketplace enrollment and operations. Critically, it also fails to extend the enhanced ACA Marketplace subsidies put in place under the American Rescue Plan and extended in the Inflation Reduction Act, which are set to expire at the end of 2025. The combined impact is projected to result in more than 12 million people losing Marketplace coverage.

Unlike the bill’s Medicaid provisions, which have a longer implementation timeline, many Marketplace changes take effect on January 1, 2026, giving consumers just four months before they will need to make hard choices and face financial tradeoffs with respect to their health insurance during the November open enrollment cycle.

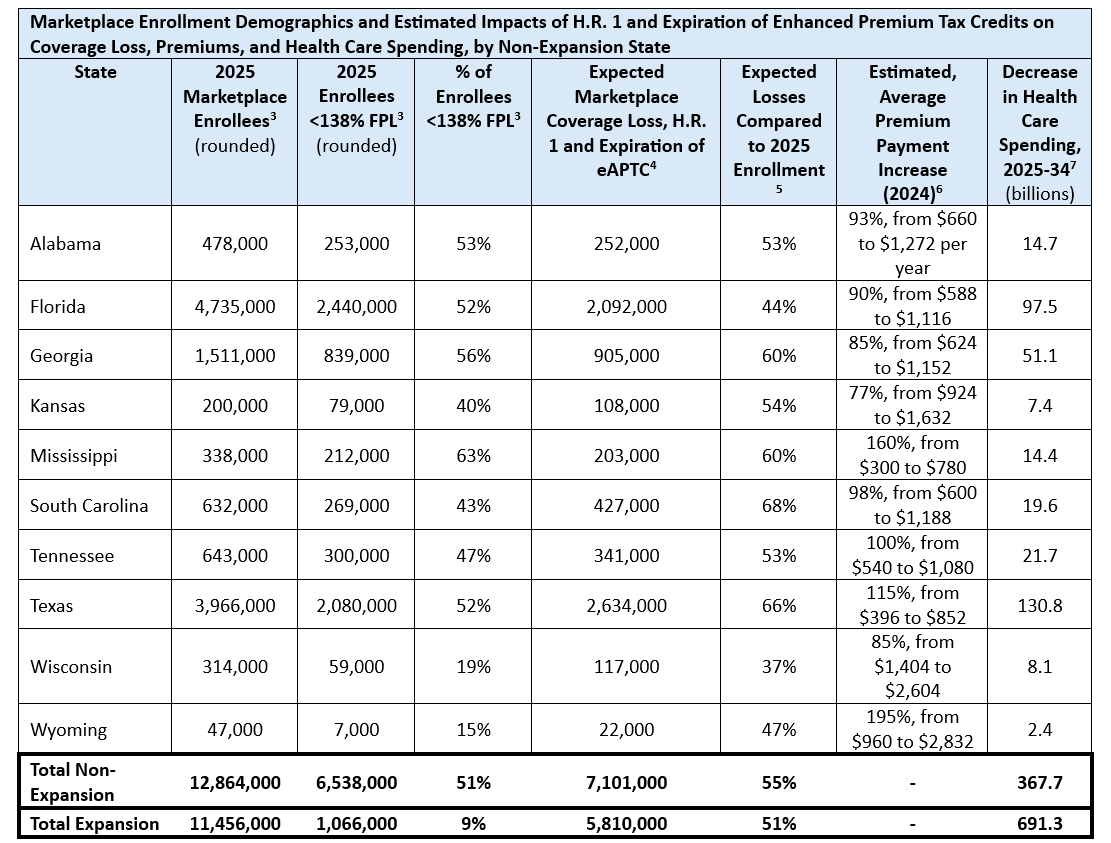

These effects will be felt nationwide. The ten states that have not expanded Medicaid to adults up to 138% of the federal poverty level (FPL) will experience the most severe coverage losses for individuals and families and financial fallout, particularly among hospitals and providers that serve low-income and rural communities. Coverage reductions are expected to drive up uncompensated care and strain provider finances. Like consumers, states and providers only have until the end of 2025 to prepare for the onset of significant changes in the Marketplace.

Although non-expansion states are more insulated from the projected Medicaid coverage losses, as H.R. 1 and the Senate’s Medicaid eligibility provisions including work requirements focus on the ACA expansion population, they rely far more heavily on the ACA Marketplace to provide subsidized insurance to low-income populations excluded from Medicaid. Residents with household incomes between 100%–138% of the federal poverty level ($15,650 to $21,600 per year for an individual) are still permitted to enroll in subsidized Marketplace coverage in these states. In most non-expansion states, more than half of Marketplace enrollees make under 138% of FPL, compared to just 9% in expansion states. (see below).

While enhanced tax credits benefit all subsidized enrollees—including small business owners, the self-employed, and middle-income families—the increased help is particularly impactful for low-income enrollees whose premium contributions drop to zero (from up to 2.07% of their income or $432/year) for the benchmark plan. Across the income spectrum, without the enhanced subsidies, enrollees in non-expansion states will see their out-of-pocket premium contributions rise by an average of 77% to 195%. Many will find this unsustainable on tight budgets and will drop out of coverage or enroll in less generous plans.

Without access to Medicaid or affordable Marketplace options, many residents of these states won’t have access to affordable health coverage and will be forced to go without, resulting in higher uninsurance rates, more delayed or emergency-only care and a steep rise in uncompensated hospital services.

According to a May 2025 by the Urban Institute, allowing the enhanced ACA subsidies to expire and passing H.R. 1, including the Medicaid provisions, could lead to nearly 16 million people becoming uninsured—resulting in a $1 trillion reduction in health care spending by 2034, with hospitals absorbing $408 billion of that loss.

In 2026 alone, provider revenues are expected to drop by $25 billion. Of that, hospitals would lose $12.3 billion, and other providers/caregivers would lose $12.6 billion. These impacts would not be distributed evenly. Non-expansion states would shoulder an outsized share of both coverage losses and provider funding gaps, because Marketplace subsidies are the only subsidized option for many low-income residents in these states.

While non-expansion states 28% of the U.S. population, by 2034, hospitals and providers in non-expansion states will lose $295 billion, or 36% of national losses. Uncompensated care is expected to reach $91 billion in the ten non-expansion states. In these states, where work requirements have less impact due to no Medicaid expansion coverage, the projected losses are driven primarily by declines in Marketplace coverage.

Hospitals in these states are particularly vulnerable. Safety-net providers, which already operate on thin margins, rely on a mix of reimbursement rates to stay afloat. Rural hospitals in non-expansion states have a operating margin of -1.5%, compared to a +1.5% median in expansion states. The loss of higher-paying Marketplace coverage will further weaken their financial stability and alter their payer mix.

When individuals lose coverage, local governments, hospitals and physicians, and those with insurance are left to absorb health care expenses uninsured individuals are unable to pay. A surge in uncompensated care could threaten the viability of local health systems already fragile from the COVID-19 pandemic and prolonged financial strain.

The proposed provisions in H.R 1 decrease eligibility and make it harder for consumers to enroll in and maintain coverage. At the same time, expiration of the enhanced ACA subsidies will make coverage significantly less affordable. Without an alternative source of insurance for most individuals losing Marketplace coverage, there will be significant revenue disruption in the provider market, potentially leading to unsustainable financial distress. In addition, without intervention to maintain affordability and decrease coverage losses, the ten states that have not expanded Medicaid should be prepared for these disruptions to come even more rapidly due to their reliance on the ACA Marketplace—with only six months to prepare.

Ellen Montz is a nationally respected health care leader bringing deep experience in the Marketplace and private insurance coverage as the former Deputy Administrator and Director at the Center for Consumer Information and Insurance Oversight at CMS from 2021–2025 and in Medicaid as former Chief Deputy and Chief Health Economist at Virginia Medicaid. Kyla Ellis recently served as Deputy Chief of Staff and Senior Advisor to the Administrator at CMS.

While the committee marks of the Senate bill do not currently include provisions in HR 1 that mirrored provisions in a proposed rule from the CMS Center for Consumer Information and Insurance Oversight (CCIIO), the result would be the same if current senate language held and CCIIO finalized the rule as it is expected to do so.

Manatt Health estimates based on Urban Institute analysis of and estimates using the Urban Institute’s Health Insurance Policy Simulation Model (HIPSM).

CMS 2025 Marketplace Public Use Files (PUF).

Manatt Health estimates based on Urban Institute analysis of and estimates using the Urban Institute’s Health Insurance Policy Simulation Model (HIPSM).

Based on CMS 2025 Marketplace PUF and Manatt Health estimate of coverage loss.

.

The study based the decline in health care spending and uncompensated care on the cost of newly uninsured individuals and did not incorporate other Medicaid financing changes present in H.R. 1 (e.g., freezing/preventing new provider taxes, retroactive eligibility)

Representing total non-prescription drug spending across non-expansion states.