CMS Obtains Meaningful Discounts for IPAY 2027 Selected Drugs

On November 25, 2025, CMS the maximum fair prices (MFPs) under the Medicare Drug Price Negotiation Program for Initial Price Applicability Year (IPAY) 2027, which will go into effect beginning January 1, 2027. The MFPs for these 15 IPAY 2027 drugs, the second cohort of the program, feature important differences from the MFPs for the inaugural cohort of ten drugs selected for IPAY 2026. Some notable outcomes include the following:

Price Reductions for IPAY 2027 Drugs: The MFP across the IPAY 2027 selected drugs is on average at a 62% discount to the 2024 list price for these products and approximately a 28% discount to the prices that would be stipulated by the estimated statutory ceiling price methodology (or “estimated MFP Ceiling Price”) in the Inflation Reduction Act. The estimated MFP ceiling price would be the lower of either the Part D net price or a price calculated based on a percentage of a product’s nonfederal average manufacturer price (non-FAMP). The percentage of non-FAMP varies depending on the number of years that have elapsed since FDA approval or licensure, and the IRA sets the percentage of the non-FAMP price at 75% for small-molecule drugs and vaccines more than nine years but less than 12 years beyond approval, 65% for drugs between 12 and 16 years beyond approval, and 40% for drugs more than 16 years beyond approval.

Product | Manufacturer | 2024 List Price, 30-Day Equivalent Supply | Estimated Part D Net Price | Estimated “MFP Ceiling Price” | MFP |

|---|---|---|---|---|---|

Ozempic/Wegovy/Rybelsus | Novo Nordisk | $959 | $428 | $428 | $274 |

Trelegy Ellipta | GSK | $654 | $305 | $305 | $175 |

Xtandi | Astellas | $13,480 | $9,470 | $7,150 | $7,004 |

Pomalyst | Bristol Myers Squibb | $21,744 | N/A | $13,086 | $8,650 |

Ofev | Boehringer Ingelheim | $12,622 | $10,643 | $9,107 | $6,350 |

Ibrance | Pfizer | $15,741 | $12,130 | $9,791 | $7,871 |

Linzess | AbbVie | $539 | $244 | $244 | $136 |

Calquence | AstraZeneca | $14,228 | $13,431 | $9,481 | $8,600 |

Austedo/Austedo XR | Teva Pharmaceuticals | $6,623 | $4,812 | $4,037 | $4,093 |

Breo Ellipta | GSK | $397 | $158 | $158 | $67 |

Tradjenta | Boehringer Ingelheim | $461 | $194 | $194 | $78 |

Xifaxan | Salix Pharmaceuticals | $2,696 | $2,186 | $967 | $1,000 |

Vraylar | AbbVie | $1,376 | $994 | $924 | $770 |

Janumet/Janumet XR | Merck | $526 | $141 | $141 | $80 |

Otezla | Amgen | $4,722 | $2,223 | $2,223 | $1,650 |

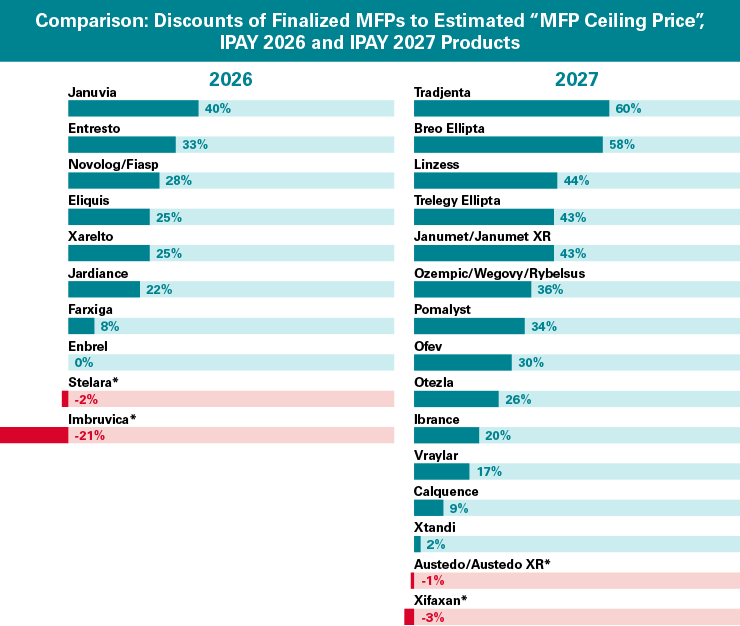

This 28% discount on average of the finalized MFPs for IPAY 2027 to the estimated MFP ceiling price represents a meaningful increase from the average delta between IPAY 2026 negotiated MFPs and their respective estimated MFP ceiling prices (16%).

A variety of factors may contribute to this dynamic, including that the selected drugs for IPAY 2027 are, on average, newer to market and less heavily rebated than products included in the IPAY 2026 list. In addition, CMS incorporated a broader range of benchmarks into potential price anchors to arrive at its initial offer and as part of its negotiations with manufacturers for IPAY 2027. These new benchmarks include, but are not limited to:

- Coverage Gap Discount Program (CGDP) payments by manufacturers into the calculation of net Part D price for a drug and its therapeutic alternatives

- Supply chain concessions offered by the manufacturer to any purchasers that are not captured in the Part D Event (PDE) data to which CMS has access

- The MFP for IPAY 2026, which may serve as therapeutic alternatives to the IPAY 2027 drugs

The incorporation of this broader set of data points for this and future years of the Negotiation Program could signal a trend in more pronounced MFP discounts going forward. This may further incentivize manufacturers to focus on contributing more evidence about the comparative effectiveness of their products relative to therapeutic alternatives in service of a better pricing outcome.

Moreover, the greater discounts for IPAY 2027 drugs likely reflect a policy commitment of the Trump Administration, as reflected in its April 15, 2025 drug pricing , to achieve greater savings than the Biden Administration.

CMS Framing of the Negotiation Results: In its announcement of the IPAY 2026 prices, the Biden administration estimated that if the negotiated MFPs had been in effect during 2023, they would have driven an additional 22% reduction in aggregate net spending across these products. For the IPAY 2027 MFPs, the Trump administration estimates that the prices CMS negotiated with manufacturers would have generated double the amount of savings (44%) to the Medicare program if the prices had been in effect during 2024.

Interaction with Other Administration Drug Pricing Initiatives: The MFP for Ozempic/Wegovy ($274) is 11% higher than the $245 price identified in the White House’s after reaching agreements with Eli Lilly and Novo Nordisk to reduce the prices at which select Medicare beneficiaries may purchase GLP-1s. On Friday, November 28, it was that CMS expects that the MFN prices for Ozempic and Wegovy to supersede the MFP negotiated by CMS.

As the White House continues to pursue directly negotiated agreements with manufacturers to secure drug cost savings either in government programs or via direct purchase by consumers at lower prices through a future TrumpRx platform, its Medicare negotiation authority under IRA will remain a lever with which to bring manufacturers proactively to the table on price concessions across their portfolio.

Note: Source for Estimated Part D Net Price (2022 Part D Net Prices) and the Estimated Non-FAMP Ceiling Price is “Selected drugs, therapeutic alternatives, and price benchmarks for IPAY 2027 Medicare drug price negotiation,” J Manag Care Spec Pharm. 2025 Oct;31(10):968-981. Source for estimated Part D Net Price (2021 Part D Net Prices) and estimated MFP ceiling price for IPAY 2026 is “Prince Benchmarks of Drugs Selected for Medicare Price Negotiation and Their Therapeutic Alternatives,” J. Managed Care Spec. Pharm. (JMCP), 2024; 30(8):762-772. Manatt did not independently estimate or attempt to verify the accuracy of these figures. The JMCP article presented two sets of prices for Stelara—the higher prices are used here. The JMCP numbers for Novolog/Fiasp were adjusted to reflect an estimated 30-day supply.

*It is unclear what accounts for the discrepancy between the estimated ceiling price and the MFP for these products, but it likely stems from variance in the statutory ceiling price calculation estimation. Under the IRA, the MFP cannot exceed the statutory ceiling price.

All figures for list prices are for a 30-day supply.